WTI Crude - Taking a Breather Near USD69.00

rhboskres

Publish date: Tue, 08 Jun 2021, 05:47 PM

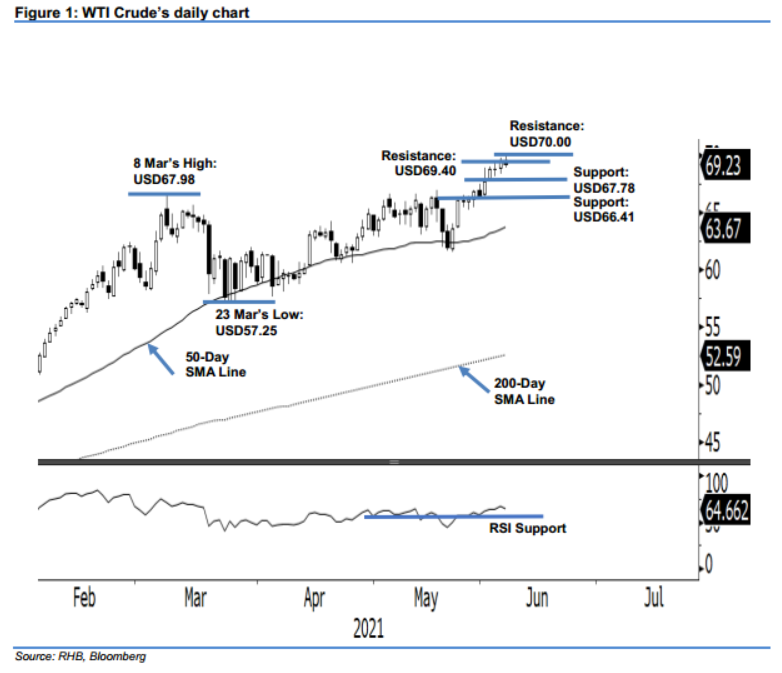

Maintain long positions. After crossing above the USD69.00 level, the WTI Crude experienced mild profit-taking, inching USD0.39 lower to settle at USD69.23. On Monday, the commodity opened at USD69.52. It then moved between the day high of USD70.00 and USD68.93 day low before closing weaker at USD69.23. Despite the WTI Crude having a mild pullback yesterday, it still moved within an upward trajectory. It may consolidate sideways in the coming sessions before it can re-test the resistance again. As long as the RSI sustains above the 50% threshold, expect the positive momentum to pick up again in the near future. As such, we maintain our positive trading bias.

Traders should keep the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is placed at USD66.41, ie the low of 1 Jun.

The nearest support is established at USD67.78 – the low of 2 Jun – and followed by USD66.41, ie 1 Jun’s low. The immediate resistance is sighted at USD69.40, or the high of 3 Jun, and followed by the USD70.00 psychological level.

Source: RHB Securities Research - 8 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024