FCPO - Mild Bullish Momentum Amid Profit-Taking

rhboskres

Publish date: Tue, 08 Jun 2021, 05:50 PM

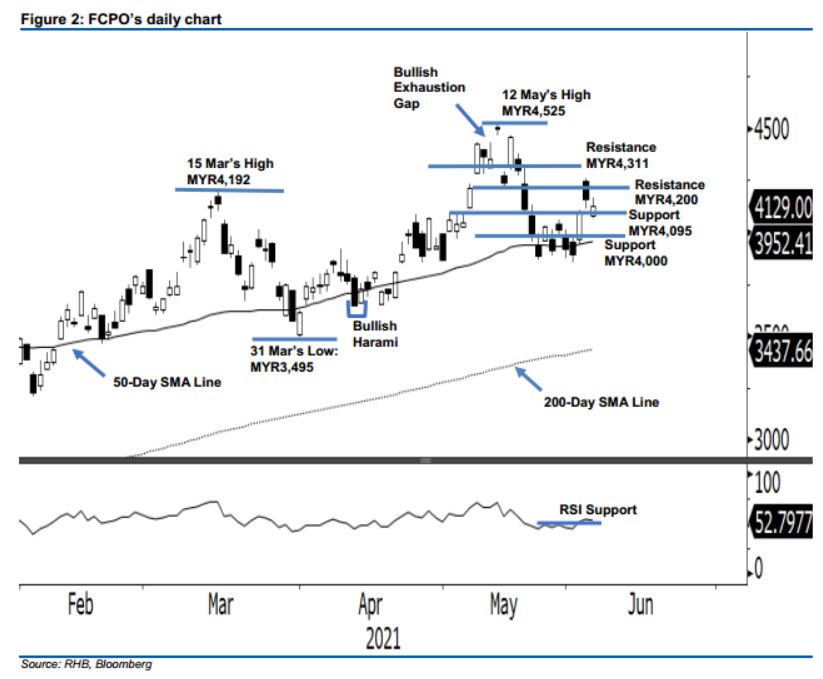

Maintain long positions. Profit-taking on the FCPO continued for two consecutive sessions last week. However, the commodity pared losses and closed MYR29.00 lower, at MYR4,129. The commodity started Friday’s session with a gap-down, at MYR4,080, to touch the day’s low of MYR4,064 before it gradually moved upwards towards day’s high of MYR4,166, then eased off towards the closing level. The strong profit-taking activity in the early session was offset by mild buying pressure throughout the session – this suggests we may see a follow-through of positive momentum in the coming sessions. However, we do not discount the possibility that profit-taking activity extended to test the 50-day SMA line (MYR3,952.41). As mentioned earlier, this immediate term correction will be confirmed if the commodity falls below the MYR4,095 support level – which is also the trailing-stop level. Until the trailing-stop level is triggered, we make no change to our positive bias.

We recommend that traders remain in long positions. We initiated these at MYR4,024, the closing level of 25 May. To manage risks, the trailing-stop is set below the MYR4,095 level, or 3 May’s high.

The support levels are maintained at MYR4,095, or 3 May’s high, followed by MYR4,000, which is the psychological level. Towards the upside, the resistance levels remain unchanged at MYR4,200, then at MYR4,311 which is 20 May’s high.

Source: RHB Securities Research - 8 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024