WTI Crude - Breaking Above USD70.00

rhboskres

Publish date: Wed, 09 Jun 2021, 05:53 PM

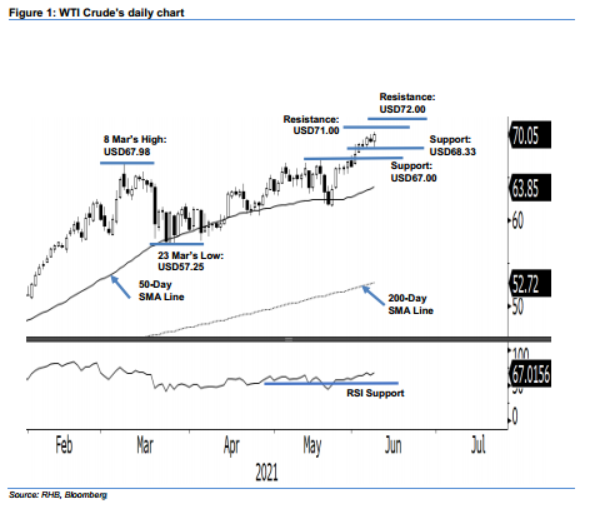

Maintain long positions. The WTI Crude saw the bullish momentum resume yesterday, breaching the USD70.00 psychological level to settle at USD70.05 – reaching a 2-year high. The commodity opened at USD69.29 yesterday and, after finding the USD68.47 day low, it progressed higher to reach the day high of USD70.27 – it last traded at USD70.05. As mentioned in our previous note, the WTI Crude is moving on an uptrend, displaying a series of “higher highs and higher lows”. Underpinned by the strong momentum, it may extend further to test the resistances at USD71.00 and USD72,00. We do not rule out a dip for profit taking and expect the USD67.00 level to provide strong support. As the bullish trend remains intact, we are keeping to our positive trading bias.

Traders should stick to the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is placed at the USD66.41 mark.

The nearest support is revised to USD68.33 – the low of 4 Jun – and followed by the USD67.00 whole number. The immediate resistance is projected at USD71.00, followed by USD72.00.

Source: RHB Securities Research - 9 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024