FCPO - Testing 50-Day SMA Line

rhboskres

Publish date: Wed, 09 Jun 2021, 06:02 PM

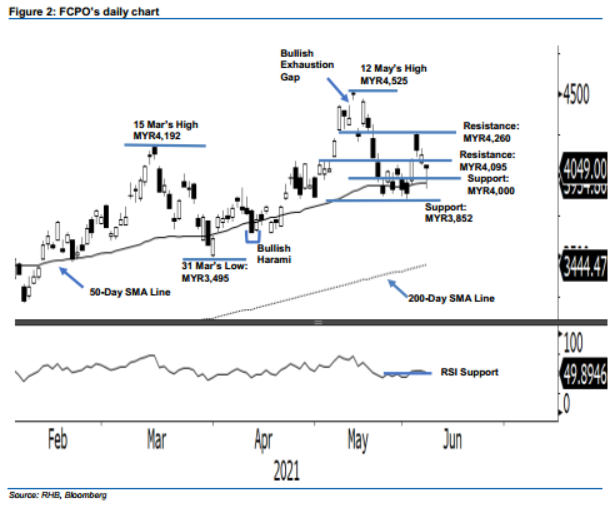

Trailing-stop triggered; initiate short positions. Yesterday saw the recent profit-taking on the FCPO continue for the third consecutive session. However, buying interest during the late session partially set-off the losses amid closing MYR80.00 lower, at MYR4,049. The commodity started Tuesday’s session with a gap-down, at MYR4,062, to touch the day’s high at MYR4,065 before it gradually moving downwards towards the day’s low at MYR3,913, only to bounce off towards the closing level at MYR4,049. The strong buying pressure near the 50-day SMA line (MYR3,954) printed a long lower shadow candlestick – a mild chance for the commodity to rebound in the immediate term. Despite the emergence of buying pressure in the late session, the commodity has fallen below the MYR4,095 support level – which is also the trailing-stop level. Since the trailing-stop level has been triggered, we switch to a negative trading bias.

We closed out the long positions, which were initiated at the closing level of 25 May, or MYR4,024, after triggering the trailing-stop of MYR4,095. Conversely, we initiate short positions at the closing level of 8 Jun, or MYR4,049. To mitigate risks, a stop-loss can be placed above 4 Jun’s high of MYR4,166.

The support levels are revised to MYR4,000, the psychological level, followed by MYR3,852, which is 1 Jun’s low. Towards the upside, the resistance levels are now MYR4,095, or 3 May’s high, and MYR4,260 which is 3 Jun’s high.

Source: RHB Securities Research - 9 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024