COMEX Gold - Continuing to Consolidate

rhboskres

Publish date: Thu, 10 Jun 2021, 05:44 PM

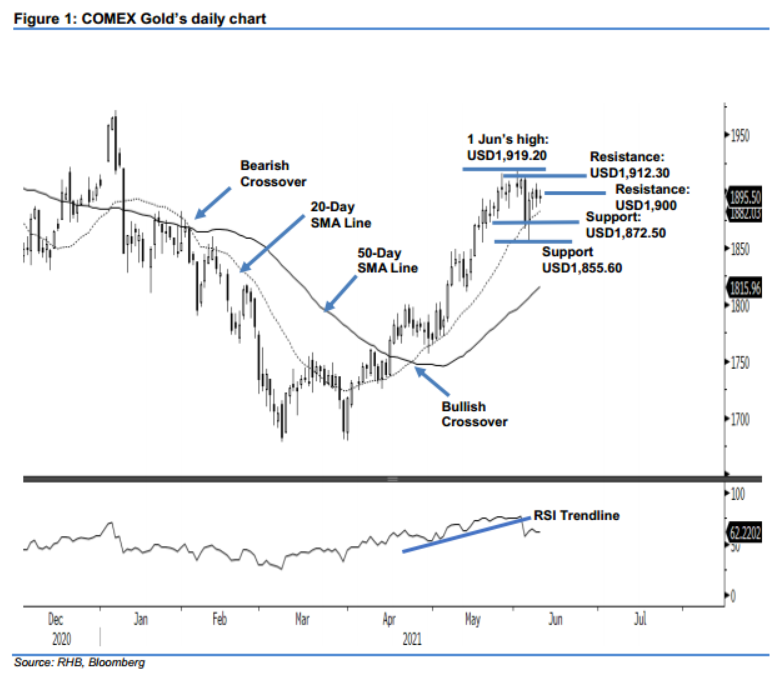

Maintain short positions. While moving in consolidation mode, the COMEX Gold saw a tepid session yesterday, gaining USD1.10 to settle at USD1,895.50. After the commodity opened at USD1,894.40, it moved narrowly between USD1,901.70 and USD1,889.30. With the RSI breaking below the trendline and pointing lower – indicating a decelerating bullish momentum – it will consolidate sideways until a successful breakout above USD1,912.30. Conversely, if it breaches the USD1,855.60 support, it may see a deeper correction towards the 50-day SMA line. At this juncture, we continue to hold on our negative trading bias untill the stop loss is triggered.

Traders should keep to the short positions initiated at USD1,873.30, or the closing level of 3 Jun. For risk management purposes, the initial stop-loss level is set at USD1,912.30, ie the high of 3 Jun.

The immediate support fixed at USD1,872.50 – 21 May’s low – and followed by USD1,855.60, or 4 Jun’s low. On the upside, the nearest resistance remains at USD1,900, followed by USD1,912.30, ie the high of 3 Jun.

Source: RHB Securities Research - 10 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024