WTI Crude - Mild Pullback From the USD70.00 Level

rhboskres

Publish date: Thu, 10 Jun 2021, 05:45 PM

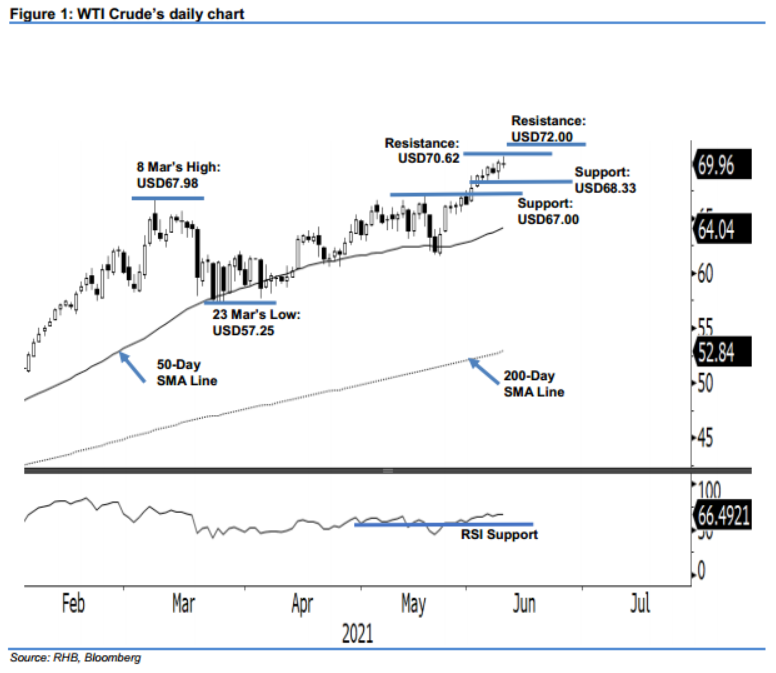

Maintain long positions. After crossing above the USD70.00 level and marking a new 2-year high, the WTI Crude pulled back on mild profit-taking to close at USD69.96. It opened at USD70.01 yesterday and rose to a session high of USD70.62 before retreating to the USD69.46 session low and settling in at USD69.96. Admist the mild profit taking activities near the USD70.00 mark, we observed that yesterday’s low was higher than Tuesday’s session low – indicating mild selling pressure. As long as the commodity continues to print “higher lows” and stays above the support levels, the uptrend will stay intact and test the upside resistance. With the bullish momentum still undergoing, we maintain our positive trading bias.

Traders are recommended to maintain the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is fixed at the USD66.41 mark.

The nearest support is marked at USD68.33 – the low of 4 Jun – and followed by the USD67.00 whole number. The immediate resistance is pegged at 9 Jun’s high of USD70.62 and followed by USD72.00.

Source: RHB Securities Research - 10 Jun 2021