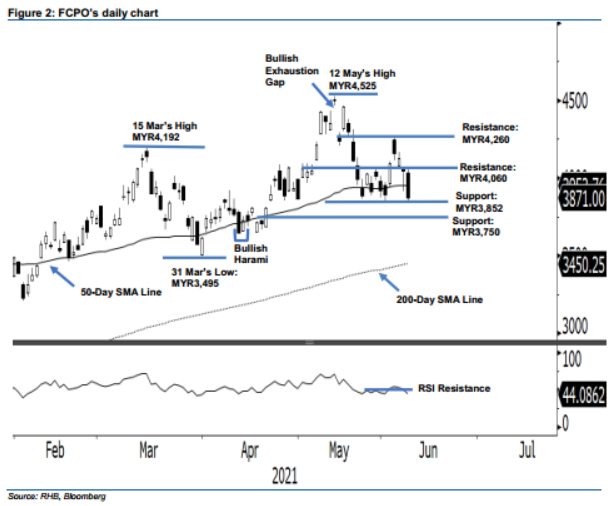

FCPO - Breaching Below The 50-Day SMA Line

rhboskres

Publish date: Thu, 10 Jun 2021, 05:48 PM

Maintain short positions. The FCPO continued its downtrend movement for the fourth consecutive session yesterday, which saw it decline MYR178 – while breaching its 50-day SMA line. Yesterday, the commodity started weaker at MYR4,030. It then touched the day’s high at MYR4,060 before it turned downwards and reached the day’s low of MYR3,854 to settle at MYR3,871. The strong selling pressure that breached the 50-day SMA line (MYR3,954) formed a long black candlestick – cancelling the mild chance for a rebound as mentioned earlier. This downward momentum will extend further if the commodity drops below the strong support level of MYR3,852 – which may see it to test MYR3,750, which is the next support level. As such, we keep to our negative trading bias.

We suggest traders to maintain short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To mitigate risks, the stop-loss is revised lower at MYR4,060 – 9 Jun’s high.

The support levels are revised to MYR3,852, which is 1 Jun’s low, followed by MYR3,750. Towards the upside, the resistance levels are revised at MYR4,060, or 9 Jun’s high, and MYR4,260 which is 3 Jun’s high.

Source: RHB Securities Research - 10 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024