FCPO - Downward Movement Extends

rhboskres

Publish date: Fri, 11 Jun 2021, 08:33 AM

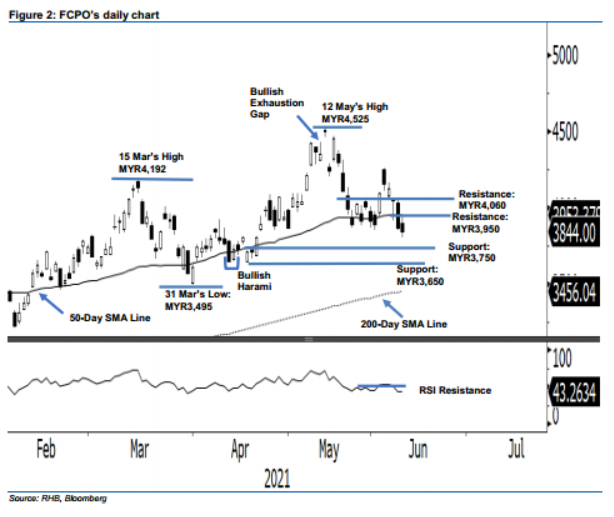

Maintain short positions. The FCPO extended its bearish momentum for the fifth consecutive session yesterday – reaching a 1-month low after it declined MYR27 to close at MYR3,844. Despite opening stronger at MYR3,897 to touch the day’s high of MYR3,950, selling pressure kicked-in later in the session to drag the commodity to the day’s low of MYR3,806 before closing at MYR3,844. Although at one point during the afternoon, it managed to stage a mild rebound, testing the 50-day SMA line (MYR3,953), selling pressure remained, causing the commodity to close lower than its opening price. Unless the commodity can cross above the 50-day SMA line (MYR3,953), the current negative momentum will follow through towards the MYR3,750 support level. Premised on this, we maintain our negative trading bias.

Traders should stay short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To manage risks, the stop-loss is pegged at MYR4,060 – 9 Jun’s high.

The support levels are marked at MYR3,750, followed by MYR3,650 or 16 Apr’s low. Towards the upside, the resistance levels are revised lower at MYR3,950 (10 Jun’s high), followed by MYR4,060 which is 9 Jun’s high.

Source: RHB Securities Research - 11 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024