WTI Crude - Bouncing Off the Support While the Uptrend Stays Intact

rhboskres

Publish date: Fri, 11 Jun 2021, 08:33 AM

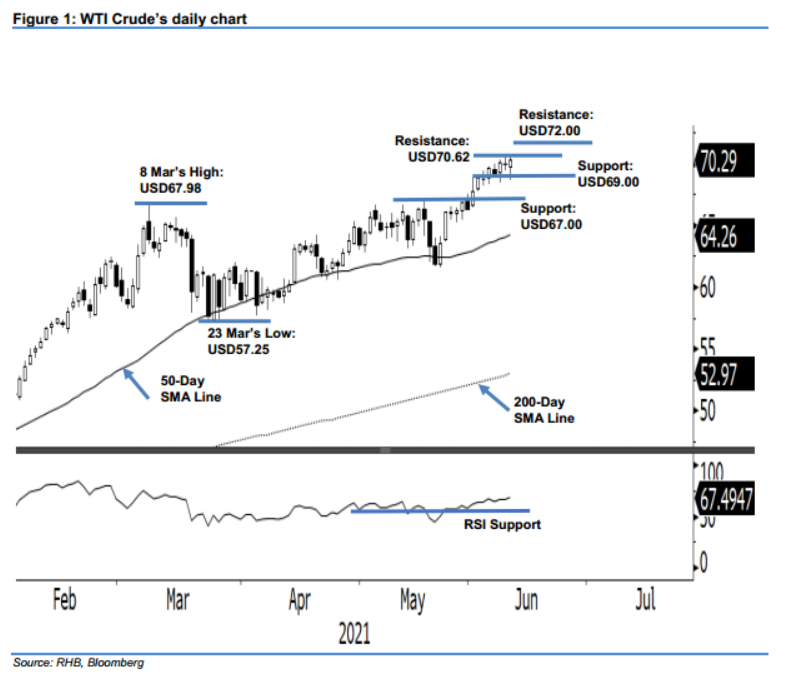

Maintain long positions. The WTI Crude managed to pare the intraday losses and stayed on its upward trajectory – adding USD0.33 to close at USD70.29. It initially opened weaker at USD69.76 before rising to the session high of USD70.65 – it later corrected to the USD68.68 session low. The WTI Crude rebounded during the late session to settle at USD70.29 – establishing a strong support near the USD69.00 mark. Since the commodity is still charting a “higher low” bullish pattern, we deem the momentum as intact. We may now see the WTI Crude rising higher to test the USD70.62 immediate resistance. If the black gold turns south again and breaks the USD69.00 support level, it may see further correction towards the USD67.00 level. At this juncture, we retain our positive trading bias.

Traders are recommended to keep to the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is revised to the USD68.68 mark, or 10 Jun’s low.

The nearest support is revised to USD69.00, followed by the USD67.00 whole number. The immediate resistance is seen at 9 Jun’s high of USD70.62 and followed by the USD72.00 level.

Source: RHB Securities Research - 11 Jun 2021