FKLI & FCPO - 11 June 2021

rhboskres

Publish date: Fri, 11 Jun 2021, 08:33 AM

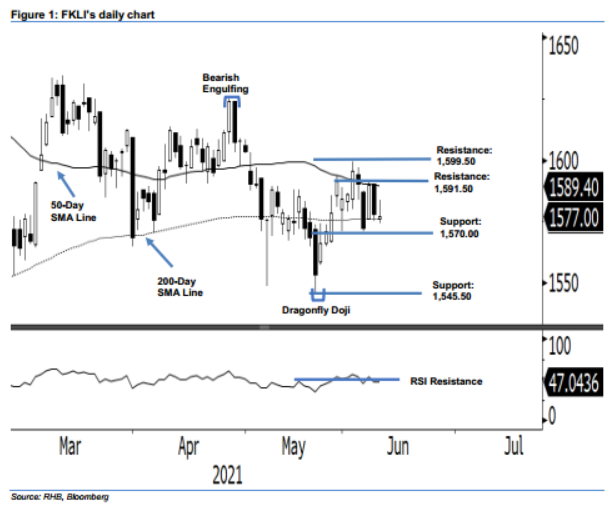

Maintain long positions. Despite the FKLI closing 1 pt lower, the bulls do not seem to be giving up just yet as the index still held on to the 200-day SMA line (1,576.1 pts). The index opened at 1,576 pts, then oscillated between the low and high of 1,574 pts and 1,583.5 pts where it formed a long upper shadow to settle at 1,577 pts. The candlestick formed yesterday was above the previous low of 1,570 pts – the stop-loss level – indicating the “higher low” base is still intact above the long-term average line, albeit, weaker. Tracking the RSI level – below the 50% threshold, suggests that the index may continue to move lower and retest the 1,570-pt nearest support level. Breaching the support may see a deeper correction ahead. Nevertheless, as the stop-loss remains intact, we maintain our positive trading bias.

We recommend traders to maintain long positions. We initiated these at the closing level of 8 Jun, or 1,590 pts. To mitigate risks, the stop-loss is pegged below 31 May’s low of 1,570 pts.

The support levels are maintained at 1,570 pts, or the low of 31 May’s low, and 1,545.5 pts (the low of 21 May). Towards the upside, the nearest resistance level remains at 1,591.5 pts, followed by 1,599.5 pts, which is 2 Jun’s high.

Source: RHB Securities Research - 11 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024