FKLI - Strong Rebound While Downward Trajectory Remains

rhboskres

Publish date: Tue, 15 Jun 2021, 11:48 AM

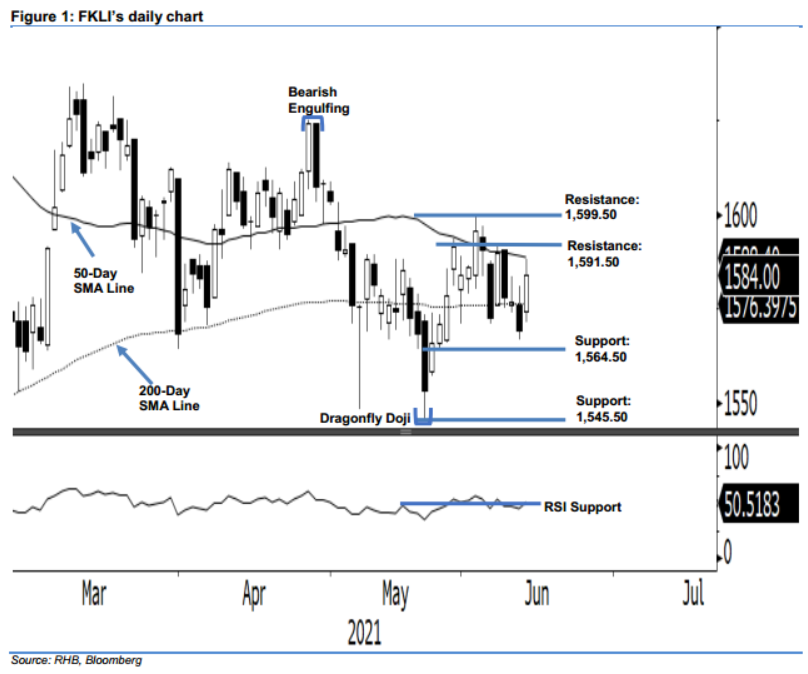

Maintain short positions. The FKLI saw a strong rebound above the 200-day SMA line, but was capped by the 50- day SMA line. The index rose 14.5 pts to settle at 1,584 pts yesterday. It opened higher at 1,574.5 pts and briefly touched the day’s low of 1,571.5 pts. It then shifted north to print the day’s high of 1,588 pts before closing. The positive momentum that breached above the 1,583.5-pt previous resistance level may follow through towards its next resistance pegged at 1,591.50 pts. However, the medium term remains bearish as it is still trading with “lower low” and “lower high” price patterns, coupled with the index trading below the 50-day SMA line. As long as the stop-loss remains intact, we stick to our negative trading bias.

We recommend traders remain in short positions. We initiated these at the close of 11 Jun, at 1,569.50 pts. To mitigate risks, the stop-loss is pegged above 1,592 pts.

The support levels are fixed at 1,564.50 pts, or the low of 25 May, followed by 1,545.5 pts, which was the low of 21 May. Towards the upside, the immediate resistance level is revised to 1,591.5 pts, or the high of 8 Jun, followed by 1,599.5 pts, which was 2 Jun’s high.

Source: RHB Securities Research - 15 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024