Hang Seng Index Futures - Staging a Positive Reversal From the 50-Day SMA Line

rhboskres

Publish date: Tue, 15 Jun 2021, 11:48 AM

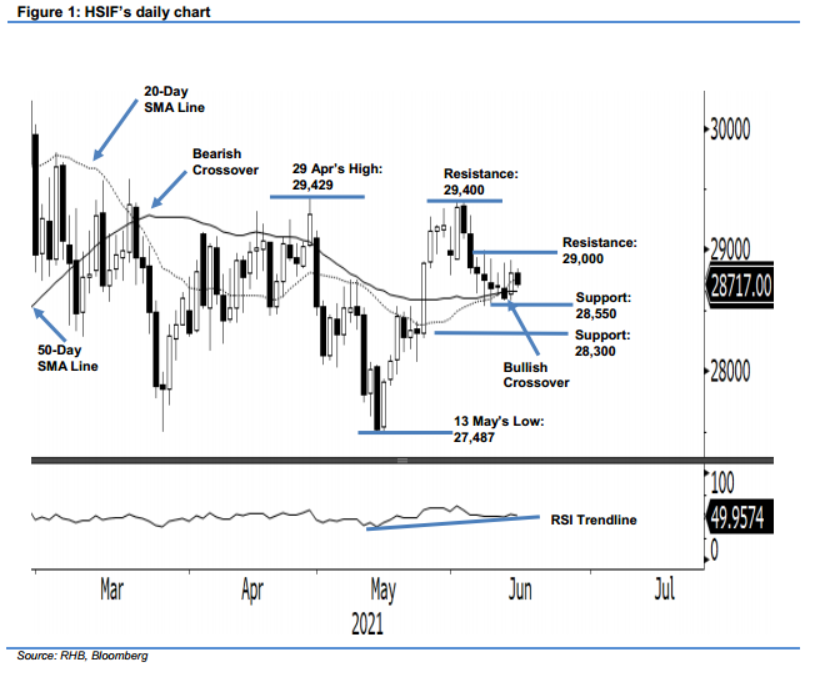

Maintain long positions. The HSIF saw a mild rebound above the 50-day SMA line last Friday, rising 198 pts to settle the day session at 28,806 pts. It started the session stronger at 28,749 pts, rising to the 28,914-pt day high. The index then formed an intraday low at 28,657 pts before closing at 28,806 pts. Profit-taking by the bears, in the evening session, dragged it lower to close at 28,717 pts. As Friday’s candlestick upper shadow was higher than Thursday’s – forming a “higher high” – coupled with its foothold above the 50-day SMA line, the probability of positive momentum following through in coming sessions is higher. Meanwhile, the 20-day SMA line has crossed above the 50-day SMA line, suggesting that the correction since 29,440 pts has ended. If the index negates expectations and corrects below the moving averages, strong selling pressure may emerge. For now, we keep our positive trading bias.

We recommend traders stay with the long positions initiated at 28,894 pts, or the closing level of 25 May’s day session. For risk management, the stop-loss threshold is placed at 28,550 pts.

The immediate support is kept at 28,550 pts, followed by 28,300 pts. Conversely, the immediate resistance is set at the 29,000-pt psychological level, followed by 29,400 pts, ie the high of 1 Jun.

Source: RHB Securities Research - 15 Jun 2021