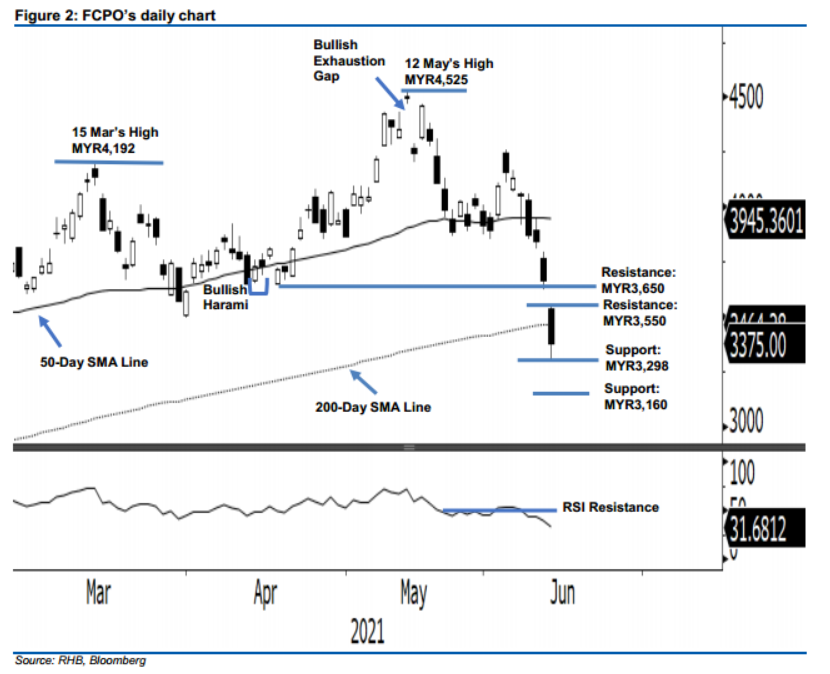

FCPO - A Sharp Decline Breaching The 200-Day SMA Line

rhboskres

Publish date: Tue, 15 Jun 2021, 11:48 AM

Maintain short positions, with lower trailing-stop. The FCPO saw accelerated downward momentum, breaching below the long-term average line by falling MYR288.00 to close at MYR3,375. Yesterday, negative momentum emerged early in the session, as the commodity gapped down to open at MYR3,539 before tapping the day’s high of MYR3,550. It then saw selling pressure drag it towards the day’s low of MYR3,298 before it pared some losses to close at MYR3,375. While the RSI is moving lower to the oversold region, the commodity continues to form a “lower low” bearish pattern, with no sign of a technical rebound yet. If the commodity fails to find a foothold at the support level of MYR3,298, it may see the negative momentum extend – testing the MYR3,160 support level, which is its multi-month low. Premised on these, we make no change to our negative trading bias.

Traders should maintain short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To manage risks and protect profits, the trailing-stop is revised lower to MYR3,650, or 16 Apr’s low.

The support levels are marked at 14 Jun’s low of MYR3,298, followed by MYR3,160 – the low of 2021. Towards the upside, the immediate resistance level is revised to MYR3,550 (14 Jun’s high) followed by the higher hurdle of MYR3,650 (16 Apr’s low).

Source: RHB Securities Research - 15 Jun 2021