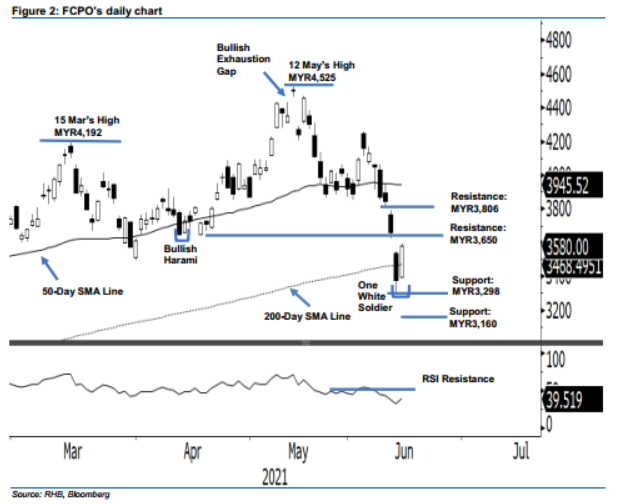

FCPO - Reversal Pattern Emerges Above 200-Day SMA Line

rhboskres

Publish date: Wed, 16 Jun 2021, 05:59 PM

Maintain short positions. After falling for seven consecutive sessions, the FCPO rebounded strongly above its 200- day SMA line to close MYR205.00 higher, at MYR3,580. Yesterday, the commodity opened stonger with a gap-up at MYR3,395, then buying pressure accelerated throughout the session – tapping the day’s high of MYR3,593 before closing near that level. This pointed to the formation of a One White Soldier, or a bullish reversal candlestick. If the bullish momentum follows though in the coming sessions and the commodity breaches the resistance of MYR3,650, we regard the correction phase as completed. Otherwise, the commodity may move sideways along the 200-day SMA line for consolidation. Before there is a follow-through of the candlestick reversal or a “higher high” pattern, there is still the risk of retracing lower to test the support level. Since it has yet to breach the trailing-stop, we stick to a negative trading bias.

Traders should stay in short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To manage risks and protect profits, the trailing-stop is pegged at MYR3,650, the low of 16 Apr.

The immediate support levels are maintained at MYR3,298 or 14 Jun’s low, followed by MYR3,160 – the low of 2021. Towards the upside, the immediate resistance level is revised higher to MYR3,650 (16 Apr’s low), followed by the higher hurdle of MYR3,806 (10 Jun’s low).

Source: RHB Securities Research - 16 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024