WTI Crude - Breaking USD72.00; Scaling Higher

rhboskres

Publish date: Wed, 16 Jun 2021, 06:04 PM

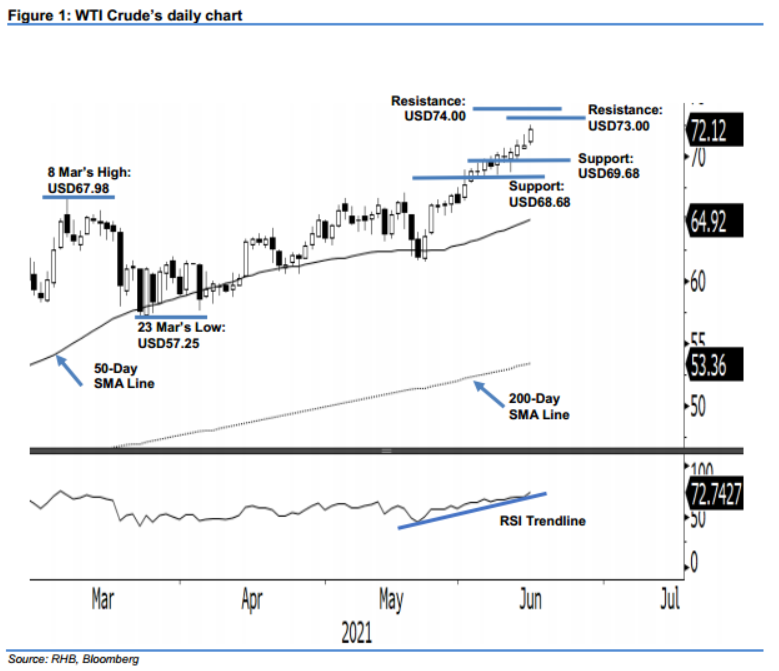

Maintain long positions. The WTI Crude is moving higher at full throttle, surging USD1.24 to settle at USD72.12. The commodity started at USD71.16 on Tuesday. After briefly touching the USD70.81 session low, it rose to the session high of USD72.49 – continuing to set a new record for 2021. Underpinned by the strong momentum, the bulls are setting their sights at the USD73.00 mark and followed by USD74.00. Meanwhile, we do not rule out mild profit-taking in the coming sessions, but see the USD69.68 level providing strong support based on the current uptrend. With still no sign of a bearish reversal yet, we maintain our positive trading bias.

We recommend traders to hold on the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is raised to the USD69.68 mark, ie 11 Jun’s low.

The nearest support is revised to USD69.68, or the low of 11 Jun, and followed by USD68.68 – the low of 10 Jun. On the upside, the immediate resistance is projected at USD73.00, followed by USD74.00.

Source: RHB Securities Research - 16 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024