E-Mini Dow - Shifting to a Negative Momentum

rhboskres

Publish date: Wed, 16 Jun 2021, 06:05 PM

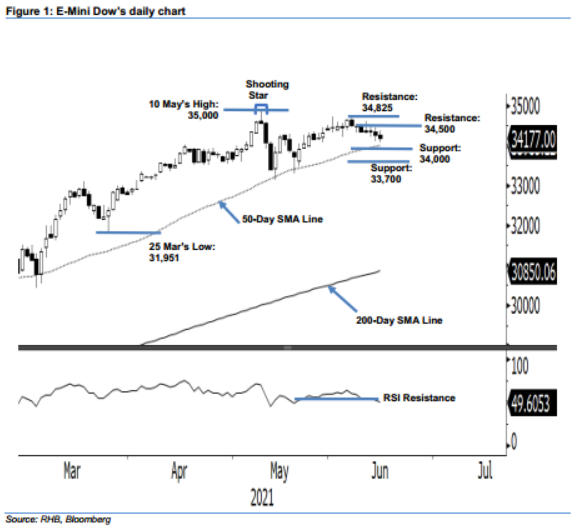

Stop loss triggered; initiate short positions. The E-Mini Dow’s June futures contract saw the bearish momentum accelerating yesterday, falling 93 pts to settle at 34,288 pts – extending the correction from 34,825 pts and breaching below the previous support level. The index started Tuesday’s session at 34,367 pts, only to see the bears dragging it lower to the 34,192-pt session low before closing at 34,288 pts. Although it is still trading above the 50-day SMA line, having seen the RSI fall below the 50% threshold, this indicates that the momentum is turning weaker. If the negative momentum accelerates further in the coming sessions, the E-Mini Dow may breach below the moving average and see a deeper correction ahead. As it has breached the stop loss, we shift to a negative trading bias.

We closed out the long positions initiated at 34,352 pts – the closing level of 24 May – after the 34,310-pt stop-loss was triggered. Conversely, initiate short positions at September’s futures contact – at the closing level of 15 Jun – or 34,177 pts. To manage the risks, the initial stop loss is set at 34,825 pts.

The immediate support is revised to the 34,000-pt psychological level, followed by 33,700 pts. Meanwhile, the immediate resistance is pegged at 34,500 pts and followed by 34,825 pts, or 7 Jun’s high.

Source: RHB Securities Research - 16 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024