WTI Crude - Mild Profit-Taking Near 2021’s High

rhboskres

Publish date: Thu, 17 Jun 2021, 05:18 PM

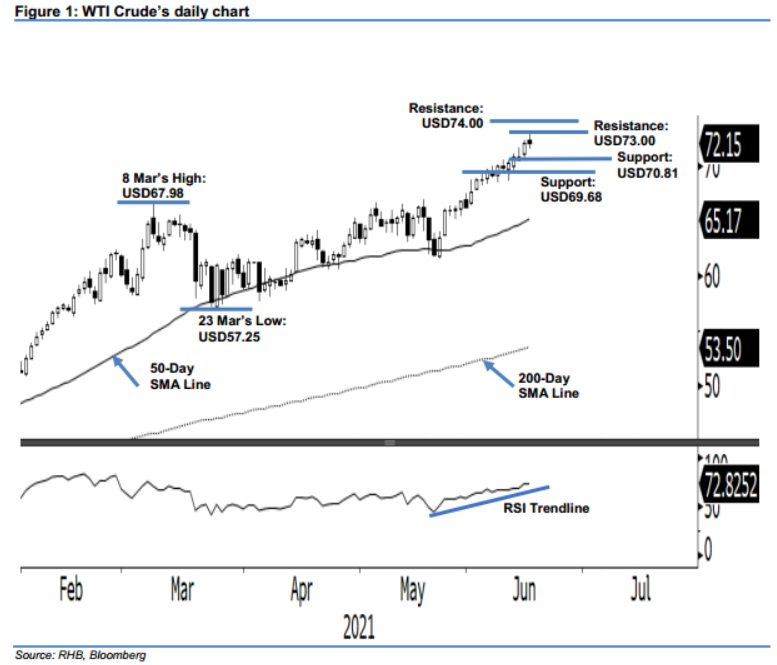

Maintain long positions. Despite the WTI Crude seeing mild profit-taking yesterday, it eked out a small gain of USD0.03 to settle at USD72.15 – continuing to make a new record-high for 2021. The commodity started the session at USD72.45 before progressing lower during the first half of this period. At one point during the US trading session, strong bullish momentum re-emerged, which lifted prices to touch the USD72.99 day high. However, profit taking took place later and it retraced again, falling to the USD71.61 day low before settling at USD72.15 – forming a black body Spinning Top. If the correction extends and falls below USD70.81, we might see negative momentum growing and potentially see the WTI Crude correct towards the USD69.68 support level. To mitigate the downside risk, we raise the trailing stop while maintaining our positive trading bias.

We recommend traders to hold on the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is revised to the USD70.81 mark, ie 15 Jun’s low.

The nearest support is marked at USD70.81, or the low of 15 Jun, and followed by USD69.68 – the low of 11 Jun. On the upside, the immediate resistance is seen at USD73.00, followed by USD74.00

Source: RHB Securities Research - 17 Jun 2021