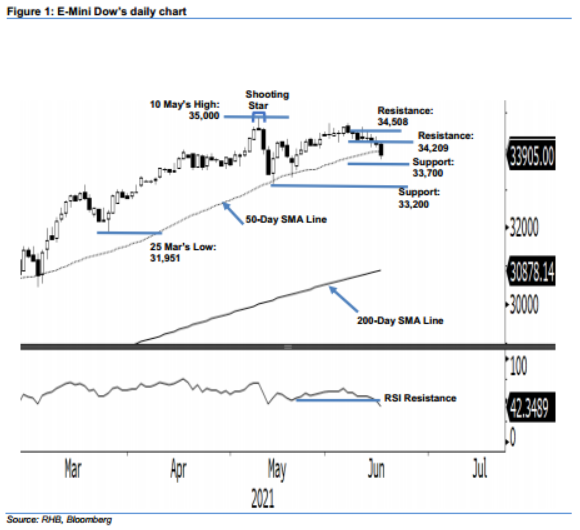

E-Mini Dow - Breaching Below 50-Day SMA Line

rhboskres

Publish date: Thu, 17 Jun 2021, 05:18 PM

Maintain short positions. The E-Mini Dow’s September futures contract saw prices falling below the crucial support of the 50-day SMA line, plummeting 272 pts to settle at 33,905 pts – the first time it closed below the moving average since 2 Feb. The index initially started Wednesday’s session stronger at 34,183 pts. After briefly touching the 34,209-pt day high, it continued to see selling pressure dragging it down to the 33,786-pt day low before rebounding mildly to close at 33,905 pts. The sentiment has become risk-off and, coupled with the RSI falling below the 50% threshold, the E-Mini Dow is likely to see the negative momentum persist. It needs to form an interim bottom before the correction is over – either we see the formation of a long lower shadow or a bullish reversal pattern. Before any of this happens, we continue to stay with our negative trading bias.

We recommend traders retain the short positions initiated at September’s futures contact – at the closing level of 15 Jun – or 34,177 pts. To manage the risks, the initial stop-loss level is placed at 34,825 pts.

The immediate support is revised to the 33,700 pts, followed by 33,200 pts – the low of 13 May. Meanwhile, the immediate resistance is pegged at the 34,209 pts, ie 16 Jun’s high, and followed by 34,508 pts – 11 Jun’s high.

Source: RHB Securities Research - 17 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024