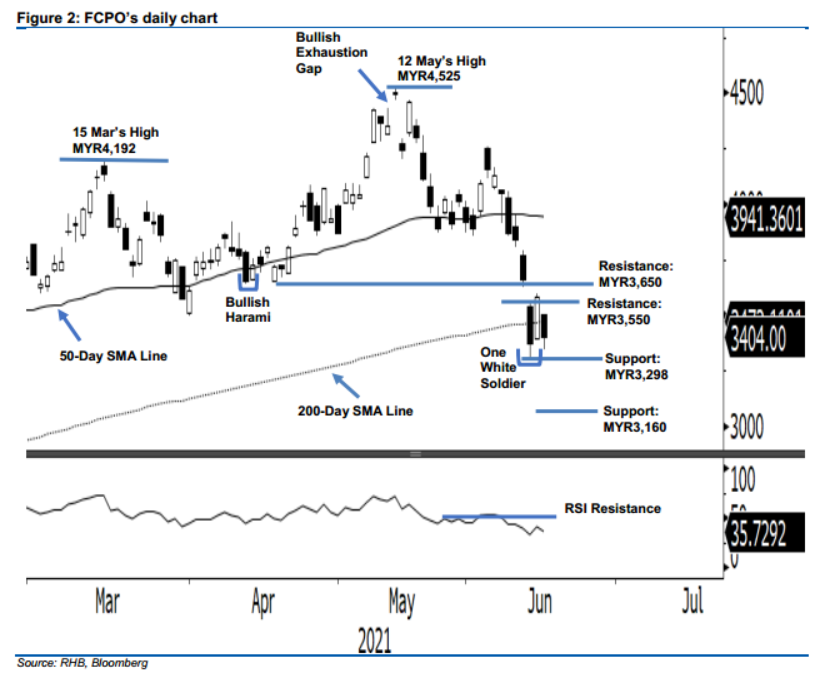

FCPO - Bears Re-emerge Below The 200-Day SMA Line

rhboskres

Publish date: Thu, 17 Jun 2021, 05:29 PM

Maintain short positions. After a sharp rebound on Tuesday, the FCPO gave up the bulk of its gains amid the breaching of the 200-day SMA line – it closed MYR176.00 weaker at MYR3,404. Despite Tuesday’s session seeing a positive close, the commodity started Wednesday’s session with a gap down – opening at MYR3,500. The selling pressure dragged it towards the day low at MYR3,340 before it rebounded mildly to close at MYR3,404. Observed: The lower shadow of the latest candlestick is higher than the One White Soldier’s lower shadow – this indicates the selling pressure is tapering while implying a bullish reversal signal may be underway. To confirm the reversal pattern, the FCPO has to at least climb above the resistance pegged at MYR3,550 to form a “higher high” pattern. Neverthelss, the impending trend remains bearish until such “higher high” price pattern is formed. As such, we maintain our negative trading bias.

Traders should remain in short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To manage risks and protect profits, the trailing-stop mark is set at MYR3,560.

The support levels stay at MYR3,298 – 14 Jun’s low – and then at MYR3,160, which was 2021’s low. Towards the upside, the immediate resistance level is pegged at MYR3,550 – the high of 14 Jun – and followed by MYR3,650, ie 16 Apr’s low.

Source: RHB Securities Research - 17 Jun 2021