FKLI - The Downtrend Is Getting Imminent

rhboskres

Publish date: Thu, 17 Jun 2021, 05:30 PM

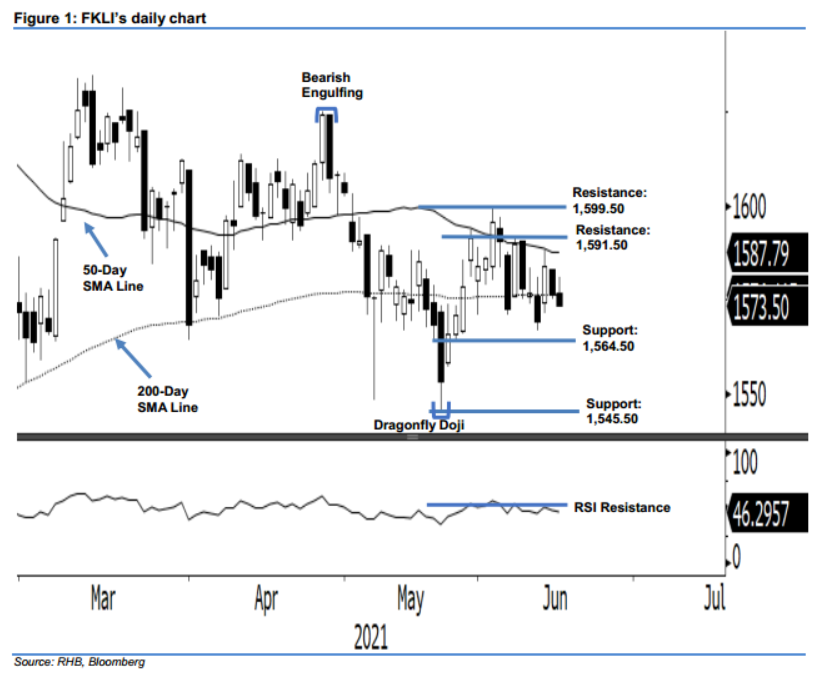

Maintain short positions. The FKLI slipped below the 200-day SMA line after it failed to stage a rebound – closing 3 pts lower and settling at 1,573 pts. The index had a neutral opening at 1,577 pts, which saw it moving higher in the early session. It reached the day high of 1,581 pts before reversing and wiping out the bullish momentum to close at its 1,573.5-pt day low. The negative momentum that emerged yesterday reconfirmed the selling pressure is persisting below the long-term average line. With the RSI indicator staying below the 50% level and pointing down, the downtrend will remain intact. Meanwhile, if FKLI fails to climb back above the 200-day SMA line, there is a high probability of it correcting towards the 1,564.50-pt support level and followed by 2021’s low of 1,545.50 pts. Due to that, we retain our negative trading bias.

We recommend traders maintain short positions. We initiated these at the close of 11 Jun, at 1,569.50 pts. To manage risks, the stop-loss threshold is set above 1,592 pts.

The support level stays at 1,564.50 pts, which was 25 May’s low, and is followed by 1,545.5 pts, ie the low of 21 May. Towards the upside, the immediate resistance level is maintained at 1,591.5 pts – 8 Jun’s high – and followed by 1,599.5 pts, or 2 Jun’s high.

Source: RHB Securities Research - 17 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024