FCPO - The Bears Are Still In Control

rhboskres

Publish date: Fri, 18 Jun 2021, 05:30 PM

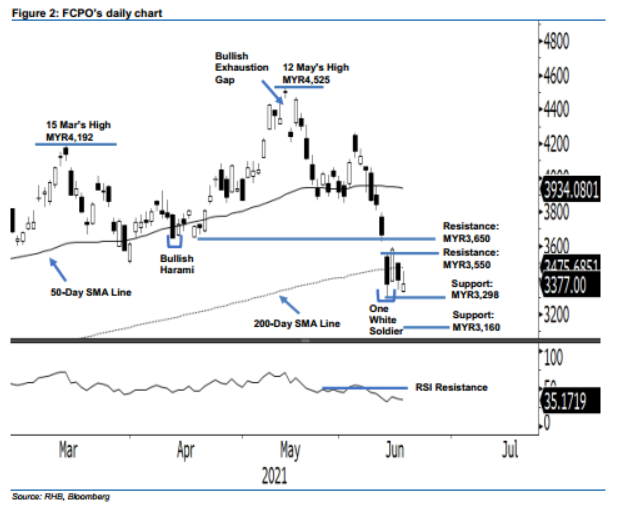

Maintain short positions. The FCPO continued its downward movement yesterday, dropping by MYR27.00 to settle at MYR3,377. The commodity opened weaker at MYR3,333 and rebounded to test the intraday high of MYR3,452. However, the bulls were not convinced, giving up gains to close at MYR3,377 – forming an “Inverted Hammer” candlestick pattern. This showed that buyers tried to build an interim base, and this may trigger a reversal of the trend in the immediate term. However, the reversal may only be confirmed if the FCPO manages to climb above the MYR3,550 nearest resistance – thereby forming a “higher high” pattern. Before that happens, the commodity may see selling pressure persist to test the support level. As such, we stick to a negative trading bias.

Traders should stay in short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To mitigate risks and safeguard profits, the trailing-stop mark is pegged at MYR3,560.

The support levels remain at MYR3,298, the low of 14 Jun, followed by MYR3,160 – the 2021 low. Towards the upside, the resistance levels are set at MYR3,550 – the high of 14 Jun –followed by MYR3,650, or 16 Apr’s low.

Source: RHB Securities Research - 18 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024