WTI Crude - Profit-Taking Activity Extended

rhboskres

Publish date: Fri, 18 Jun 2021, 05:30 PM

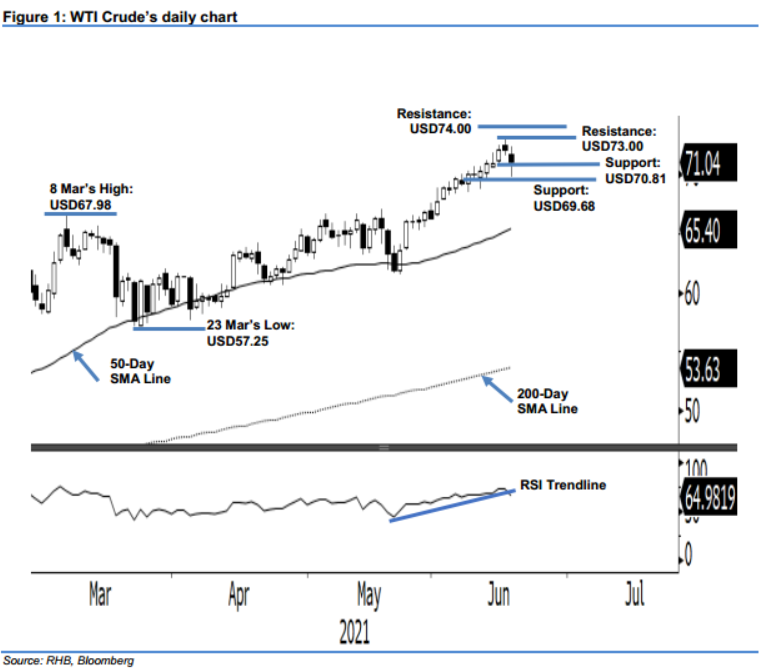

Maintain long positions. The WTI Crude saw profit-taking extend yesterday, retracing USD1.11 to settle at USD71.04 – while the uptrend structure stayed intact. Yesterday, the commodity initially had a stronger opening, starting the session at USD71.65 and climbing towards the USD72.30 day’s high. However, selling pressure increased in the middle of the US trading session, where the commodity fell back to USD69.77 before rebounding to close at USD71.04 – forming a long lower shadow candlestick pattern. The latest price action shows the commodity has managed to defend the USD70.81 support level while forming a new “high low” pattern. If this support level gives way, the black gold may see prices undergo a deeper correction. With the RSI at the brink of breaking below the trendline, we maintain our positive trading bias until the traling-stop is breached.

Traders should keep the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop threshold is set at the USD70.81 mark, ie 15 Jun’s low.

The nearest support remains at USD70.81, or the low of 15 Jun, and followed by USD69.68 – the low of 11 Jun. On the upside, the immediate resistance is seen at USD73.00, followed by USD74.00.

Source: RHB Securities Research - 18 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024