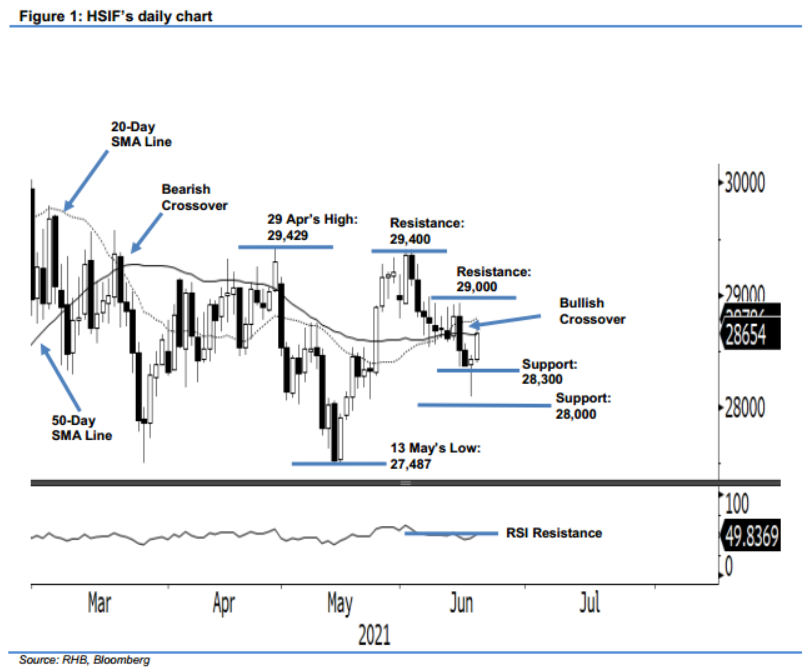

Hang Seng Index Futures - Testing the 50-Day SMA Line Resistance

rhboskres

Publish date: Fri, 18 Jun 2021, 05:30 PM

Maintain short positions. Despite strong selling pressure earlier in the session, the HSIF managed to hold on to the support levels, staging a strong rebound yesterday to conclude the day at 28,432 pts. Strong buying interest emerged near the intraday low of 28,088 pts while keeping the 28,300-pt support level intact and forming a Bullish Hammer pattern. During the evening session, the bullish momentum continued to lift the index higher to close at 28,524 pts. At the time writing, the index climbed to 28,654 pts on Friday morning – indication of an ongoing bullish sentiment. As long as the bullish momentum continues, it has a probability to cross above the 50-day SMA line. If this happens, the Bullish Crossover signal that was negated previously may be reactivated. The 20-day SMA line is still above the 50- day SMA line, suggesting an stronger upward movement. However, unless the HSIF can reclaim the 50-day SMA line territory, we regard the moving average as a resistance, and maintain our negative trading bias.

Traders should hold on to their short positions initiated at the closing level of 15 Jun’s day session, ie 28,509 pts. For risk-management purposes, the initial stop-loss threshold is fixed at 29,100 pts.

The immediate support stays at 28,300 pts, followed by 28,000 pts. Meanwhile, the immediate resistance is pegged to the 29,000-pt psychological level and followed by 29,400 pts, or the high of 1 Jun.

Source: RHB Securities Research - 18 Jun 2021

.png)