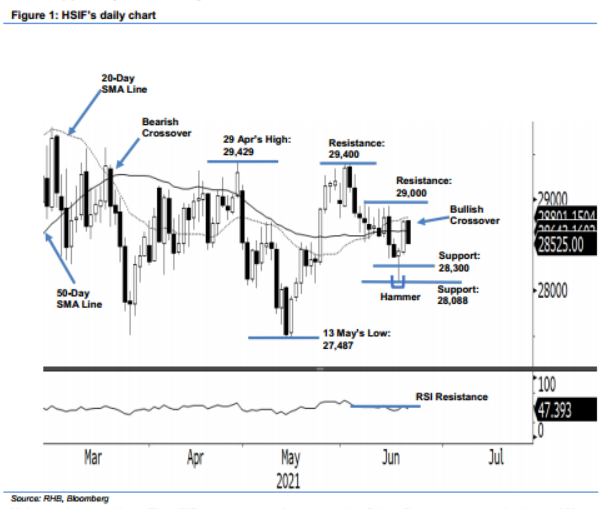

Hang Seng Index Futures - Still Capped by the 50-Day SMA Line Resistance Level

rhboskres

Publish date: Mon, 21 Jun 2021, 10:57 AM

Maintain short positions. The HSIF saw a session of two halves last Friday. During the day session it rose 329 pts to settle at 28,761 pts, while in the evening session, it gave up most of the gains, declining 236 pts to close at 28,525 pts. The recent rebound movement, which started from the low of 28,088 pts, was blocked by the wall of the 50-day SMA line. It is also observed that, since touching the 29,400-pt high on 1 Jun, the index has moved lower for three consecutive weeks – showing that the bears have an upper hand, and are staging selling pressure near the 20-day and 50-day moving averages. If the index manages to neutralise the selling pressure and consolidates above the 28,300-pt support level, it may cross above the 50-day SMA line again, averting a potential Bearish Crossover of the two SMA lines. Otherwise, the 20-day SMA line may turn lower and drag the index down to eventually retest the 28,088-pt support level. For now, we are keeping our negative trading bias.

We recommend traders maintain the short positions initiated at the closing level of 15 Jun’s day session, ie 28,509 pts. For risk-management purposes, the initial stop-loss is set at 29,100 pts.

The immediate support is marked at 28,300 pts, followed by the low of the Hammer, or 28,088 pts. Meanwhile, the immediate resistance is placed at the 29,000-pt psychological level, followed by 29,400 pts, or the high of 1 Jun.

Source: RHB Securities Research - 21 Jun 2021