WTI Crude - Bulls Still in Control

rhboskres

Publish date: Mon, 21 Jun 2021, 10:57 AM

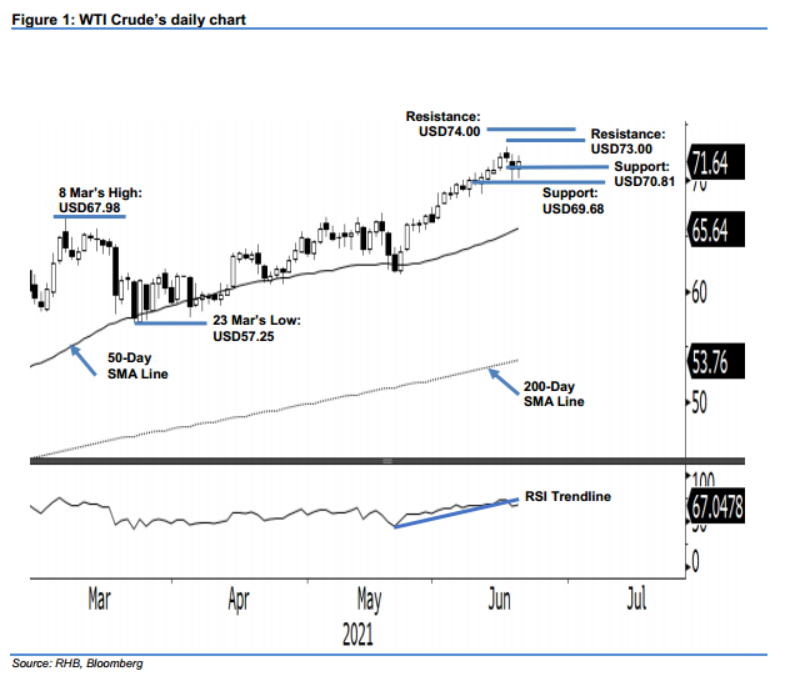

Maintain long positions. Despite the WTI Crude giving up the bulk of its intraweek gains, strong demand emerged on Friday, lifting prices USD0.60 higher to settle at USD71.64 – posting a four consecutive week winning streak. The commodity started Friday’s session weaker at USD71.10, and fell to the intraday low of USD70.16. In the early part of the US trading session, it rose to the day’s high of USD72.17 before closing at USD71.64, with strong buying interest emerging near the USD70.00 level. As the commodity rebounded from the USD70.00 level, forming a “higher low” pattern, we deem the bulls as still in control of the uptrend. However, we remain cautious as the RSI is breaching the trendline. If the RSI starts pointing downwards in the coming sessions, the risk of corrective movement will increase. We hold on to our positive trading bias until the trailing-stop is breached.

We suggest traders stick to the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate risks, the trailing-stop threshold is placed at the USD70.81 mark, or 15 Jun’s low.

The nearest support is fixed at USD70.81, or the low of 15 Jun, followed by USD69.68 – the low of 11 Jun. On the upside, the immediate resistance is sighted at USD73.00, followed by USD74.00.

Source: RHB Securities Research - 21 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024