COMEX Gold - Downward Movement Poised to Extend

rhboskres

Publish date: Mon, 21 Jun 2021, 10:57 AM

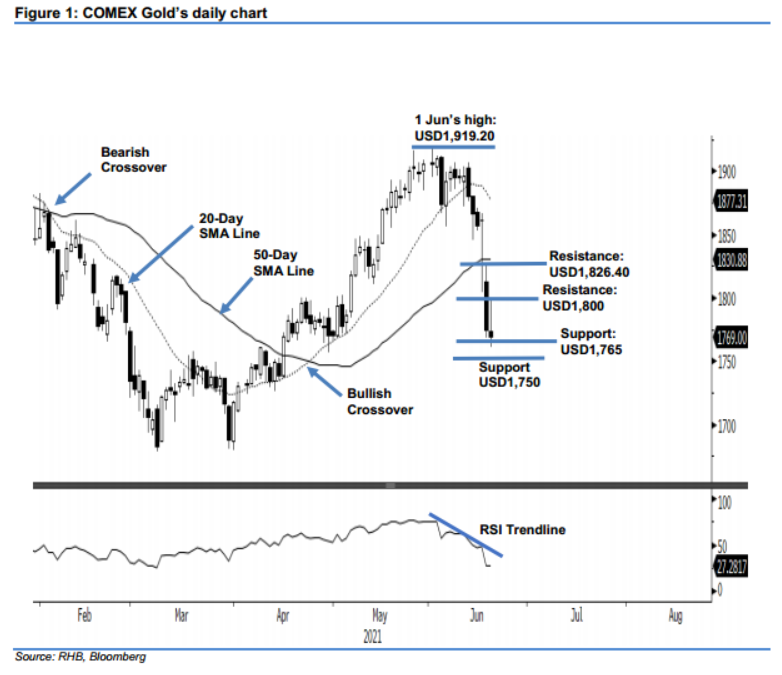

Maintain short positions. The COMEX Gold saw its downward movement extend, declining USD5.80 to settle at USD1,769 – recording 2021’s worst week so far. It started Friday’s session at USD1,773.90 and rose to the day’s high of USD1,797.90. It then gave up all the intraday gains, dropping to the USD1,761.20-day low before closing at USD1,769. Tracking the RSI indicator moving into oversold level, the commodity may attempt to find an interim support between the USD1,765 and USD1,750 support levels. If it forms a long lower shadow or a bullish candlestick, it may stage a technical rebound from the support level. Otherwise, a breach of the USD1,750 support level will see a deeper correction towards USD1,700. Unless it forms an interim base, we think it will continue its downward trajectory. We maintain our negative trading bias.

Traders are advised to keep the short positions initiated at USD1,873.30, or the closing level of 3 Jun. For risk management purposes, the trailing-stop is set above USD1,815.

The immediate support remains at USD1,765, followed by the USD1,750 round number. Meanwhile, the nearest resistance is sighted at USD1,800, followed by the USD1,826.40 high of 17 Jun.

Source: RHB Securities Research - 21 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024