FKLI - Climbing Back Above The 200-Day SMA Line

rhboskres

Publish date: Mon, 21 Jun 2021, 10:58 AM

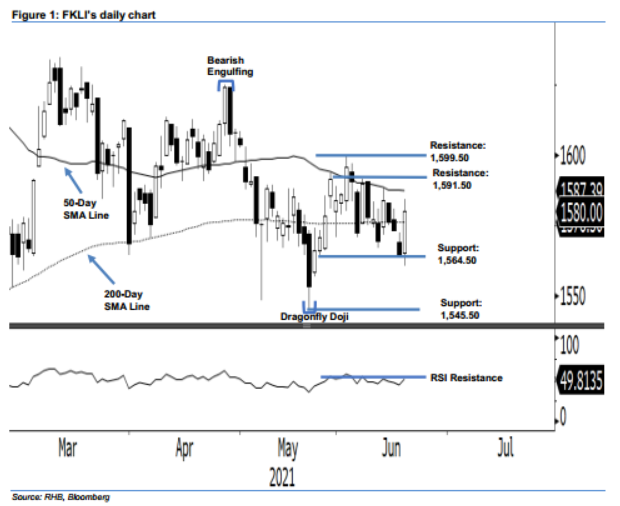

Maintain short positions. The FKLI reverted its momentum to positive last Friday; it rose 15.5 pts to close at 1,580 pts, ie above the 200-day SMA line. The index opened at 1,565.5 pts, which then saw the momentum weaken towards the intraday low at 1,560.5 pts. After that, strong buying pressure lifted the FKLI – it reversed its course and climbed towards the 1,584.5-pt day high before settling at 1,580 pts. The strong bullish momentum emerged on Friday, indicating a potential reversal in the coming sessions. The RSI indicator is also turning higher, suggesting that the index may get a boost if the positive momentum can follow through in the coming sessions. Although the direction in the immediate term is positive, the FKLI is still forming a “lower high” in the medium term. Unless the 1,591.5-pt resistance is breached – forming a “higher high” bullish pattern – we maintain a negative trading bias.

We suggest traders stay in short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To mitigate risks, the stop loss is pegged above 1,592 pts.

The immediate support level remains at 1,564.50 pts, which was 25 May’s low, and then 1,545.5 pts – the low of 21 May. Towards the upside, the resistance levels are unchanged at 1,591.5 pts, or 8 Jun’s high, and 1,599.5 pts, which was 2 Jun’s high.

Source: RHB Securities Research - 21 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024