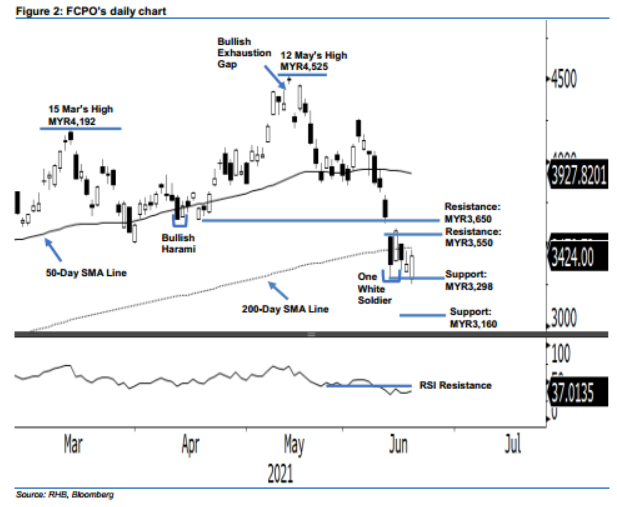

FCPO - Struggling Near The 200-Day SMA Line

rhboskres

Publish date: Mon, 21 Jun 2021, 10:59 AM

Maintain short positions. The FCPO’s recent rebound was blocked by the 200-day SMA line despite it inching up MYR47.00 last Friday to close at MYR3,424. The commodity opened weaker at MYR3,290. After forming the intraday low at MYR3,251, it turned higher towards the MYR3,460 day high before settling at MYR3,424 – forming a white body candlestick. Based on the FCPO’s recent sessions’ price actions, strong buying interest emerged near the MYR3,298 support level. If the commodity establishes a strong support at this level, it may potentially form a Bullish Reversal pattern to stage a technical rebound and test the MYR3,550 resistance. Breaching this resistance may confirm it has completed the recent correction phase. Conversely, if the FCPO is observed trading below the 200-day SMA line, the recent positive price action could be shortlived and see the commodity reverting to a downward movement. Hence, we stick to our negative trading bias until the traling stop is breached.

Traders should remain in short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To manage risks and safeguard profits, the trailing-stop mark is set at MYR3,560.

The immediate support level is set at MYR3,298 – the low of 14 Jun – and then MYR3,160, or the 2021 low. Towards the upside, the resistance levels are unchanged at MYR3,550 and MYR3,650, ie 14 Jun’s high and the low of 16 Apr.

Source: RHB Securities Research - 21 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024