Hang Seng Index Futures - Consolidating Before the 50-Day SMA Line Resistance

rhboskres

Publish date: Tue, 22 Jun 2021, 10:57 AM

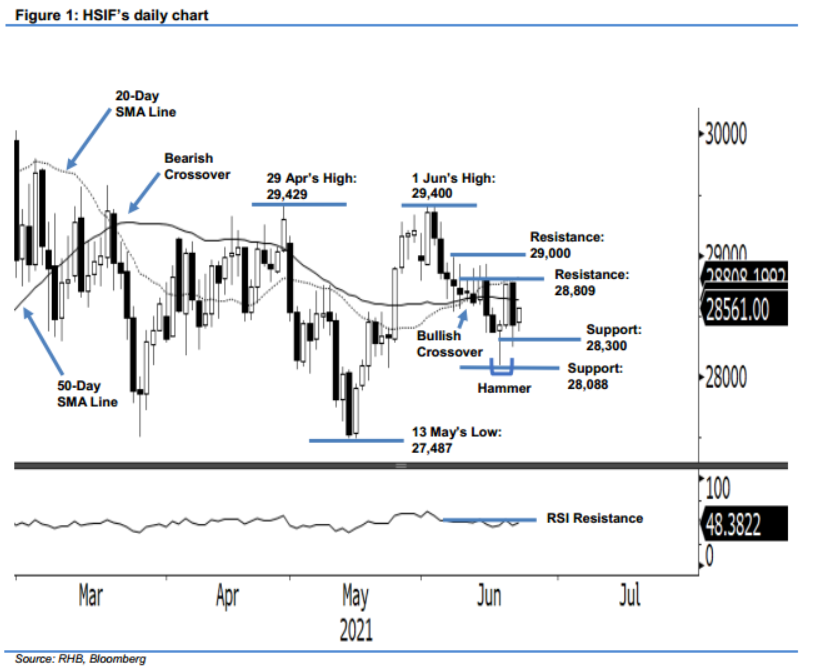

Maintain short positions. The HSIF failed to reclaim the 50-day SMA line, declining 339 pts to settle the day session at 28,422 pts. The index opened weaker yesterday at 28,490 pts. It oscillated between the 28,517-pt day high and day low of 28,243 pts before closing lower at 28,422 pts. In the evening, it managed to climb higher and closed at 28,561 pts after rebounding from the 28,368-pt session low. The HSIF is currently consolidating sideways just beneath the overhead resistance of the 50-day SMA line. If the bearish momentum picks up pace again, it may see a downward movement to re-test the 28,300-pt support level, followed by 28,088 pts. Looking at the RSI indicator, the momentum remains weak. As such, we maintain our negative trading bias.

Traders are recommended to hold on the short positions initiated at the closing level of 15 Jun’s day session, ie 28,509 pts. For risk-management purposes, the stop-loss level is revised to 28,890 pts.

The immediate support remains at 28,300 pts, followed by the low of the Hammer, or 28,088 pts. Conversely, the immediate resistance is pegged at the 28,809 pts – 9 Jun’s high – and followed by 29,000 pts.

Source: RHB Securities Research - 22 Jun 2021