WTI Crude - Breaking Past USD73.00

rhboskres

Publish date: Tue, 22 Jun 2021, 10:57 AM

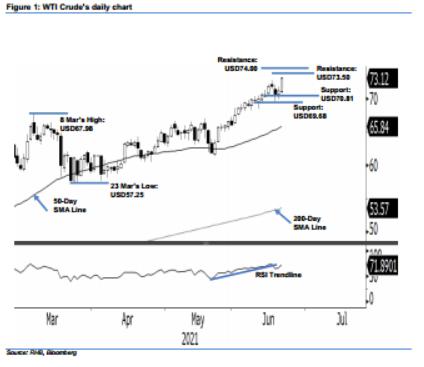

Maintain long positions. The WTI Crude’s August futures contracts extended the upward movement, jumping USD1.83 to settle at USD73.12 – a new record for 2021. The commodity initially had a soft start yesterday, opening at USD71.15 before dipping to the USD70.78 day low. Strong demand during the US trading session lifted prices to touch the USD73.28 day high before settling at USD73.12 – forming a Bullish Marubozu candlestick. The white body candlestick indicates the bulls are still dominating the session, and the WTI Crude is well on track to test the upside resistance. If it breaches USD73.50, the next level will be USD74.00. While moving higher, strong support was established at USD70.81. Since the bullish momentum is intact, we keep to our positive trading bias.

We recommend traders maintain the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate the risks, the trailing-stop threshold is adjusted to the USD70.78 mark, ie 21 Jun’s low.

The immediate support is placed at USD70.81, or the low of 15 Jun, and followed by USD69.68 – the low of 11 Jun. On the upside, the immediate resistance is projected at USD73.50 and followed by USD74.00.

Source: RHB Securities Research - 22 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024