WTI Crude - Mild Profit-Taking; Uptrend Remains

rhboskres

Publish date: Wed, 23 Jun 2021, 05:57 PM

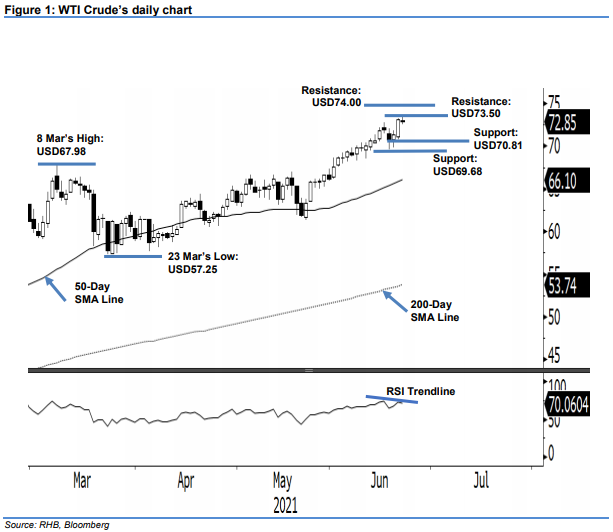

Maintain long positions. The WTI Crude’s August futures contracts saw the upward movement pausing after yesterday’s mild profit-taking – it declined USD0.27 to close at USD72.85. The commodity started Tuesday’s session at USD73.04. It then oscillated between USD73.47 and USD72.47 before its close. Note: The previous July futures contracts expired yesterday – where the bulls and bears repositioned themselves again. Observed: The RSI indicator is showing a divergence signal with the WTI Crude’s price trend – we expect profit-taking activities to be extended in the immediate term, but believe the USD70.81 level will provide strong support. Once the profit taking or consolidation is over, the commodity may see the momentum pick up again to re-test the resistance at USD73.50 – this is followed by USD74.00. Premised on this, we keep to our positive trading bias.

Traders should hold on to the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate the risks, the trailing-stop threshold is placed at the USD70.78 mark, ie 21 Jun’s low.

The immediate support is established at USD70.81, or the low of 15 Jun. This is followed by USD69.68 – the low of 11 Jun. Meanwhile, the immediate resistance is eyed at USD73.50, followed by USD74.00.

Source: RHB Securities Research - 23 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024