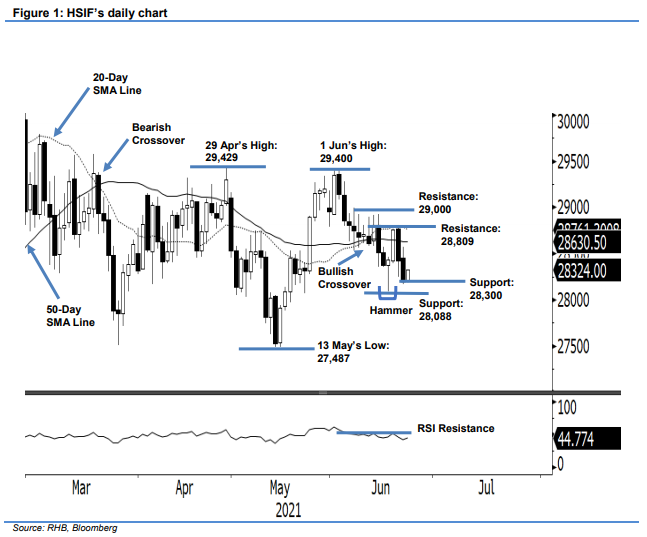

Hang Seng Index Futures - Struggling Near the Support Level

rhboskres

Publish date: Wed, 23 Jun 2021, 05:57 PM

Maintain short positions. After being rejected from the 50-day SMA line, the HSIF again tested the support level fixed at 28,300 pts. The index started the day session yesterday at 28,520 pts and barely touched the 28,539-pt day high. It then saw selling pressure, which dragged it towards the 28,164-pt day low before settling at 28,193 pts – a 229-pt decline vis-à-vis Monday’s session. The HSIF recouped 131 pts to conclude the evening session at 28,324 pts. Observed: The index formed a Hammer pattern on 17 Jun, indicating a strong support established between 28,300 pts and 28,088 pts. Hence, although the HSIF is still moving on a downward trend, there might be a technical rebound from the strong support levels to re-test the 50-day SMA line. However, with the weak RSI, we expect the 28,809-pt resistance level to stay intact. As such, we are keeping to our negative trading bias.

We recommend traders stick to the short positions initiated at the closing level of 15 Jun’s day session, ie 28,509 pts. For risk-management purposes, the stop-loss level is placed at 28,890 pts.

The immediate support is unchanged at 28,300 pts, followed by the low of the Hammer, or 28,088 pts. On the upside, the immediate resistance is sticking to 28,809 pts – 9 Jun’s high – and followed by 29,000 pts.

Source: RHB Securities Research - 23 Jun 2021