COMEX Gold - Consolidating Sideways

rhboskres

Publish date: Thu, 24 Jun 2021, 09:32 AM

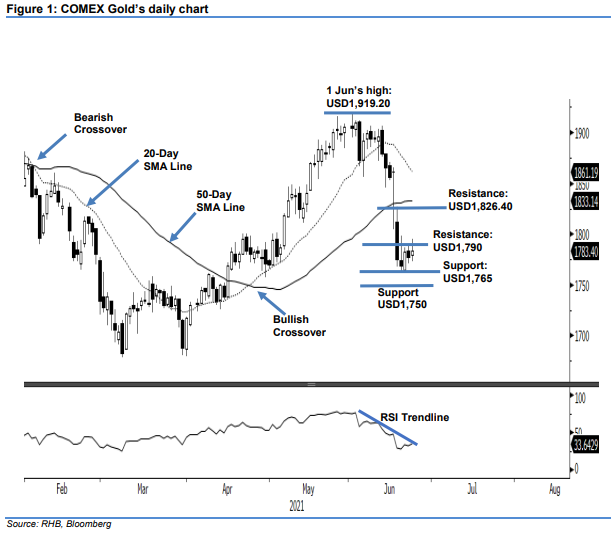

Maintain short positions. Despite being blocked by the resistance pegged at USD1,790, the COMEX Gold managed to add USD6.00 to settle at USD1,783.40. It initially started Wednesday’s session flat at USD1,779.10. After much sideways movement, it jumped to test the intraday high at USD1,795.60. However, the resistance proved too strong for the commodity, which saw it retrace to the USD1,773.10 session low – it closed at USD1,783.40. With the latest price action, it is very likely that the COMEX Gold will consolidate between USD1,790 and USD1,765 before re-attempting to cross the immediate resistance again. It has to cross above the immediate resistance to stage a meaningful technical rebound towards USD1,826.40. Meanwhile, another strong support level is marked at USD1,750. At this juncture, we are keeping our negative trading bias until the trailingstop level is breached.

We recommend traders to hold on to the short positions initiated at USD1,873.30, or the closing level of 3 Jun. For risk-management purposes, the trailing-stop level is placed at USD1,790.

The immediate support is marked at USD1,765, followed by the USD1,750 round number. Meanwhile, the immediate resistance is eyed at USD1,790 whole number and followed by USD1,826.40, ie 17 Jun’s high

Source: RHB Securities Research - 24 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024