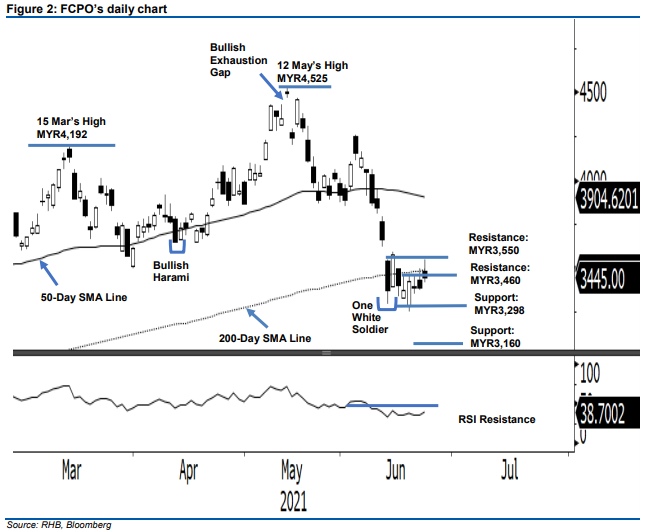

FCPO - Hesitating To Cross 200-Day SMA Line

rhboskres

Publish date: Thu, 24 Jun 2021, 09:32 AM

Maintain short positions. The FCPO’s intra-day high yesterday breached above the 200-day SMA line, but failed to retain the territory, despite closing MYR55.00 higher at MYR3,445 yesterday. It started positive at MYR3,485, then registered an intra-day high of MYR3,548 before shifting direction southwards, to record an intra-day low of MYR3,421 just before closing – forming a Shooting Star bearish pattern. The latest price action indicates that selling pressure is prevailing near MYR3,460 and MYR3,550 resistance level. If the commodity climbs back above the 200-day SMA line (MYR3,491), the sentiment may turn positive. Until the commodity reclaims the spot and breaches the trailing stop, we maintain a negative trading bias.

Traders should stick to short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To manage risks and protect profits, the trailing-stop is pegged above MYR3,500.

The support levels are set at MYR3,298 – the low of 14 Jun – then MYR3,160, or the 20 Jan’s low. Towards the upside, the resistance levels are set at MYR3,460 – the high of 18 Jun and MYR3,550, or 14 Jun’s high.

Source: RHB Securities Research - 24 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024