FKLI - Testing Immediate Support Leve

rhboskres

Publish date: Thu, 24 Jun 2021, 09:36 AM

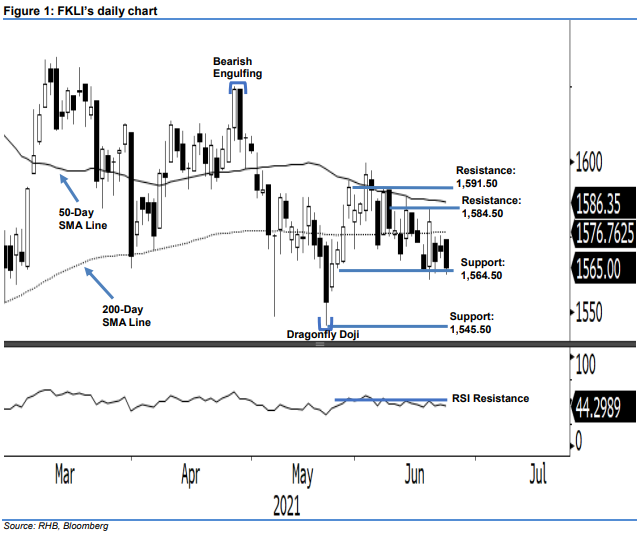

Maintain short positions. The FKLI formed a bearish candlestick and retested the immediate support level, shedding 5.5 pts to close at 1,565 pts yesterday – a level below the 200-day SMA line. Despite starting the day higher at 1,574 pts, bears came into the picture, and the index printed the intra-day low of 1,562.50 pts before closing. The bearish momentum indicates that selling pressure remains in effect at the 200-day SMA line. This, coupled with the RSI momentum decelerating from 46.40% to 44.30%, leads us to believe that the downward pressure remains intact. As such, we maintain a negative trading bias.

We recommend that traders stay in in short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To mitigate risks, the stop-loss is set above 1,592 pts.

The support levels are unchanged at 1,564.50 pts, which was the low of 25 May, and 1,545.5 pts or 21 May’s low. Towards the upside, the resistance levels are still at 1,584.50 pts, or 18 Jun’s high. Then the next resistance level is set at 1,591.50 pts, or the high of 8 Jun.

Source: RHB Securities Research - 24 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024