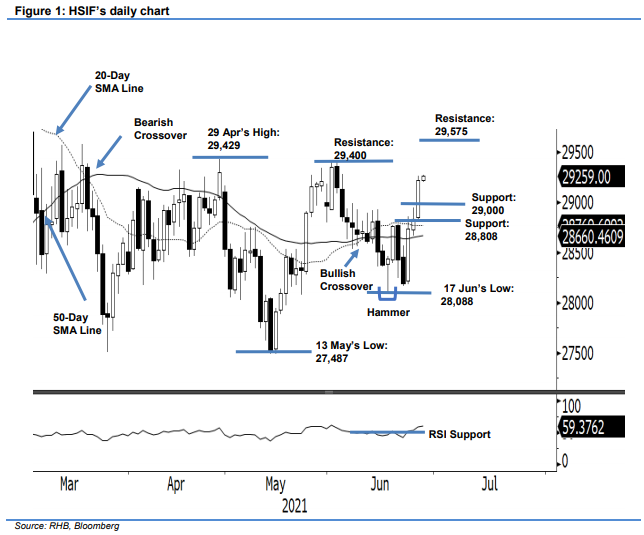

Hang Seng Index Futures - Moving Back Above the 29,000-pt Level

rhboskres

Publish date: Mon, 28 Jun 2021, 09:01 AM

Maintain long positions. The HSIF turned risk-on again last Friday, reclaiming the 29,000-pt level to settle the day session at 29,218 pts. On Friday, it opened stronger at 28,923 pts. After barely touching the 28,891-pt day low, the index turned higher and rose to the 29,256-pt day high before closing at 29,218 pts. In the evening session, it edged higher and was last traded at 29,259 pts – at this juncture, it managed to recoup its previous weeks’ losses and record a fresh three-week high. If bullish momentum sustains, the index may test the 29,400-pt level or May’s high. A breach of this level may see it accelerate towards the multi-week high of 29,575 pts. While keeping the positive expectation, we do not rule out the possibility of profit-taking by the bears. However, strong support can be found near the 29,000-pt mark. Given the strong momentum, we stick to a positive trading bias.

We recommend traders keep to the long positions initiated at 28,904 pts or the closing level of 25 Jun’s evening session. To mitigate risks, the stop-loss level is revised higher to 28,659 pts.

The immediate support is revised to 29,000-pt round number, followed by 28,808 pts. On the upside, the immediate resistance is set 29,400 pts – the high of 1 Jun – followed by 29,575 pts, or the high of 18 Mar.

Source: RHB Securities Research - 28 Jun 2021