Hang Seng Index Futures - Expect Mild Profit-Taking Near the Resistance Level

rhboskres

Publish date: Tue, 29 Jun 2021, 08:50 AM

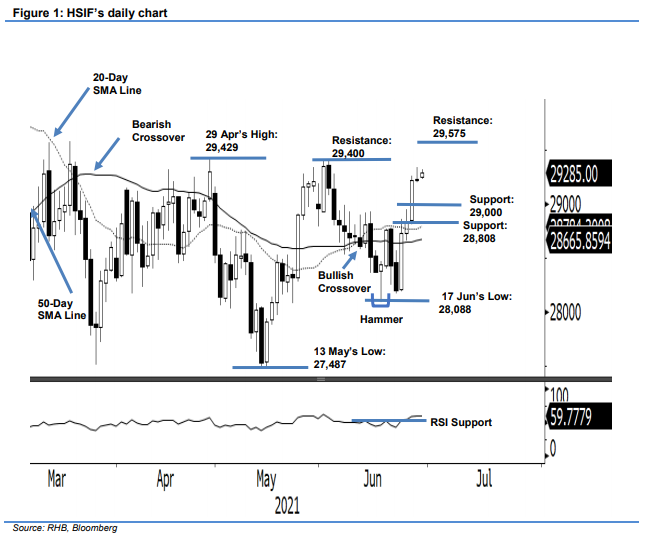

Maintain long positions. Due to extreme weather conditions yesterday morning, the HSIF only traded in the afternoon session – inching 6 pts higher to close at 29,224 pts. It started the afternoon session at 29,250 pts, and touched an intraday high of 29,333 pts. Later in the session, it retraced to the 29,207-pt day low and settled at 29,224 pts. In the evening session, the index tracked its US peers to rise 61 pts, ending at 29,285 pts. Overall, the index is still seeing a risk-on sentiment, ahead of the 1 Jul market holiday. In the coming session, the June futures contract will expire, and move on to the July contract. Expect some profit-taking activities just before the holiday on Thursday. As long as the index stays above both the 20-day and 50-day SMA lines, the uptrend remains intact. As such, we keep our positive trading bias.

Traders are recommended to maintain the long positions initiated at 28,904 pts or the closing level of 25 Jun’s evening session. To mitigate risks, the stop-loss is set at 28,659 pts.

The immediate support is marked at 29,000-pt round number, followed by 28,808 pts. Conversely, the immediate resistance is eyed at 29,400 pts – the high of 1 Jun – followed by 29,575 pts, or the high of 18 Mar.

Source: RHB Securities Research - 29 Jun 2021