Hang Seng Index Futures - Hovering Near the 29,000-Pt Psychological Level

rhboskres

Publish date: Wed, 30 Jun 2021, 04:39 PM

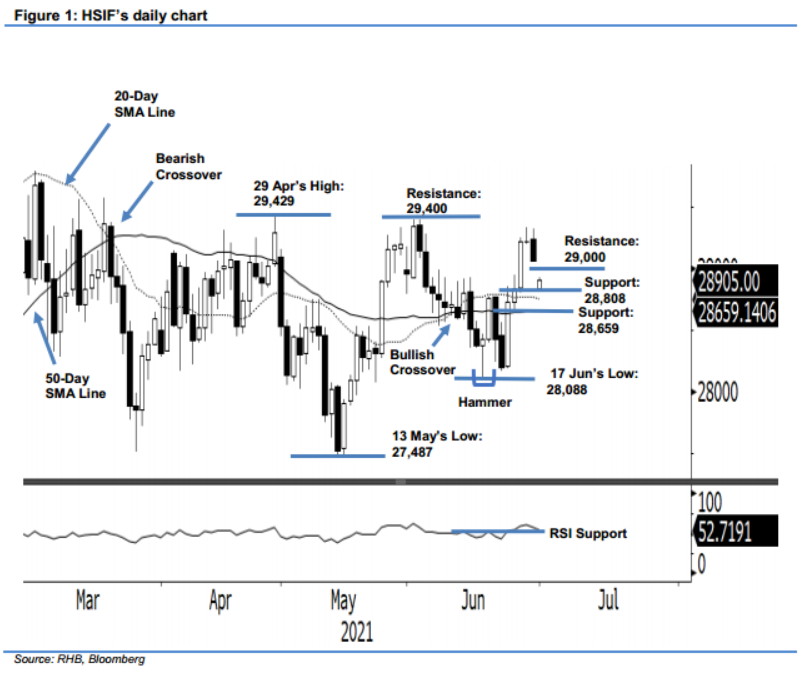

Maintain long positions. The HSIF saw June futures contracts expire and settle at 29,064 pts yesterday. During this period, the July futures contracts settled at 28,846 pts when the day session ended. During the evening session, these contracts rebounded slightly and last traded at 28,905 pts – the selling pressure dragged the index to fall below the 29,000-pt psychological level. On the eve of the Hong Kong market holiday, we may continue to see some weakness in the HSIF. On the downside, it may test the support of the 50-day SMA line, which is near to 28,659 pts. If the selling pressure subsides, we believe the momentum may pick up again to retest the immediate resistance at 29,000 pts. As long as the index sustains above the stop-loss point, we keep to our positive trading bias.

We suggest traders hold on the long positions initiated at 28,904 pts, or the closing level of 25 Jun’s evening session. To manage risks, the stop-loss mark is fixed at 28,659 pts.

The immediate support is revised to 28,808 pts – the low of 25 Jun – and followed by 28,659 pts, ie the low of 24 Jun. Meanwhile, the immediate resistance is set at the 29,000-pt psychological level and followed by 29,400 pts – the high of 1 Jun.

Source: RHB Securities Research - 30 Jun 2021