FKLI - Downside Risks Remain

rhboskres

Publish date: Thu, 01 Jul 2021, 05:43 PM

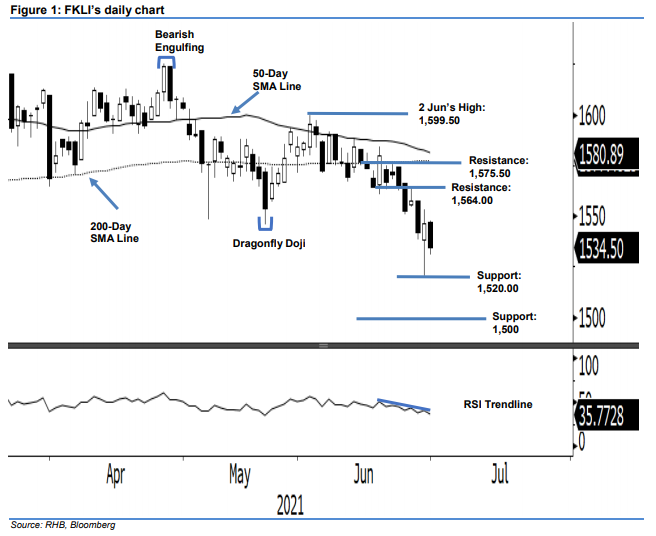

Maintain short positions. Yesterday, during the last trading session for June, the FKLI saw the re-emergence of selling pressure, which dragged it 12 pts lower to settle at 1,534.50 pts. The index started slightly higher at 1,547 pts, and immediately fell south throughout the session, touching the intraday low of 1,531 pts before closing at 1,534.50 pts. The recent bearish movement implies that the bulls are not convinced with the interim base formed at the support level of 1,520 pts. Underpinned by the RSI trendline pointing south below the 40% level, bearish momentum may drag the index to retest the 1,520-pt level. As such, we stick to our negative trading bias.

Traders should stay in short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To mitigate risks, the stop-loss threshold is set at 1,575.50 pts.

The support levels are lowered to 1,520 pts – 29 Jun’s low – followed by the psychological level of 1,500 pts. Towards the upside, the resistance levels remain at 1,564.00 pts or the high of 25 Jun, and 1,575.50 pts – the high of 22 Jun.

Source: RHB Securities Research - 1 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024