FKLI - Negative Momentum Extends

rhboskres

Publish date: Fri, 02 Jul 2021, 05:13 PM

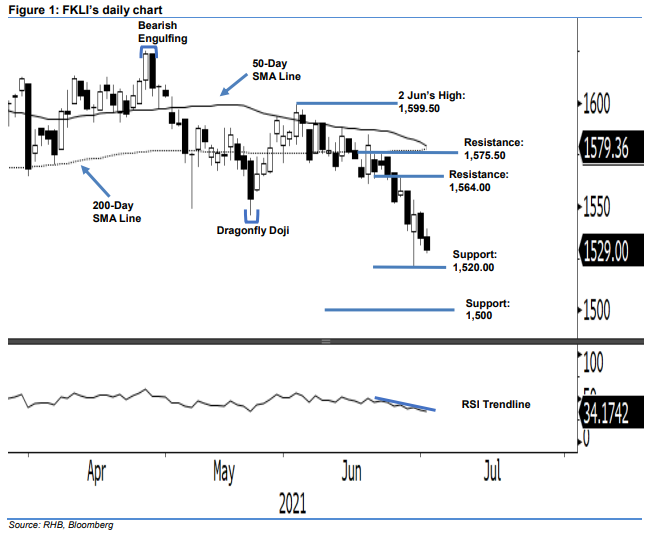

Maintain short positions. In line with the recent trend, the FKLI moved lower, shedding 4 pts to close at 1,529 pts – nearing the immediate support level. The index opened neutral at MYR1,535.5 and moved upwards to tap the day’s high of MYR1,539.5 before reversing, in the late afternoon, to touch the day’s low of 1,527 pts. It closed weaker at 1,529 pts. This price action reaffirmed that the bears are in the driver’s seat. As the RSI is trending below the 40% level, the odds are higher for the index to see the formation of a “lower low” pattern in the coming sessions. Premised on this, we make no change to our bearish trading bias.

Traders should maintain short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To mitigate risks, the stop-loss threshold is pegged at 1,575.50 pts.

The support levels are unchanged at 1,520 pts – 29 Jun’s low – followed by the psychological level of 1,500 pts. Towards the upside, the resistance levels are maintained at 1,564.00 pts or the high of 25 Jun, and 1,575.50 pts – the high of 22 Jun.

Source: RHB Securities Research - 1 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024