Hang Seng Index Futures - Falling to a 4-Week Low

rhboskres

Publish date: Mon, 05 Jul 2021, 09:21 AM

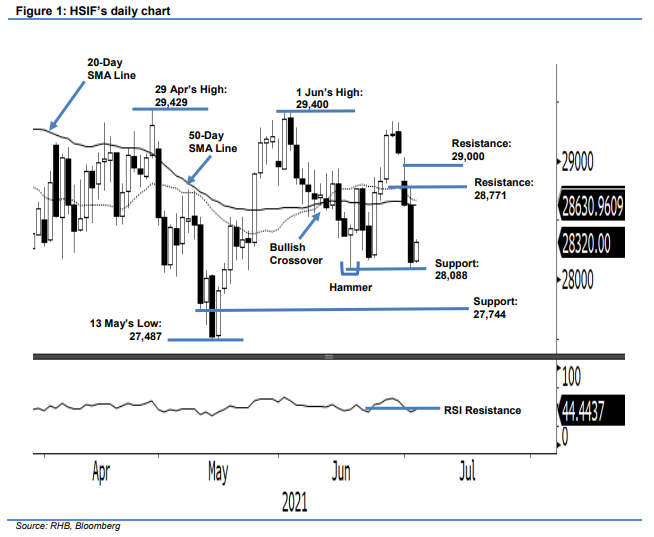

Maintain short positions. On the first trading session after the market holiday, the HSIF saw selling pressure extend, falling 481 pts to settle the day session at 28,149 pts – its worst performance since 13 May. On Friday, the index opened at 28,680 pts. After touching the 28,771-pt day high, it fell rapidly to the 28,805-pt day low before seeing a mild rebound to close at 28,149 pts. After the weak day session, it recouped 171 pts in the evening session to close at 28,320 pts. With risk-off sentiment looming, the bears are eyeing the immediate support level of 28,088 pts. If the support level gives way, the Hammer pattern will be negated, and further correction will be seen. Typically, support levels tend to be weak in a downtrend market. In the worst scenario, the index could fall towards 27,487 pts, or May’s low, in the near future. We maintain our negative trading bias.

We recommend traders keep the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. For risk management, the stop-loss is adjusted to 28,850 pts.

The immediate support is revised to 28,088 pts – 17 Jun’s low – followed by 27,744 pts, or the low of 11 May. Conversely, the immediate resistance is revised to 28,771 pts, followed by the 29,000-pt psychological level.

Source: RHB Securities Research - 5 Jul 2021