COMEX Gold - Testing the 20-Day SMA Line

rhboskres

Publish date: Wed, 07 Jul 2021, 05:48 PM

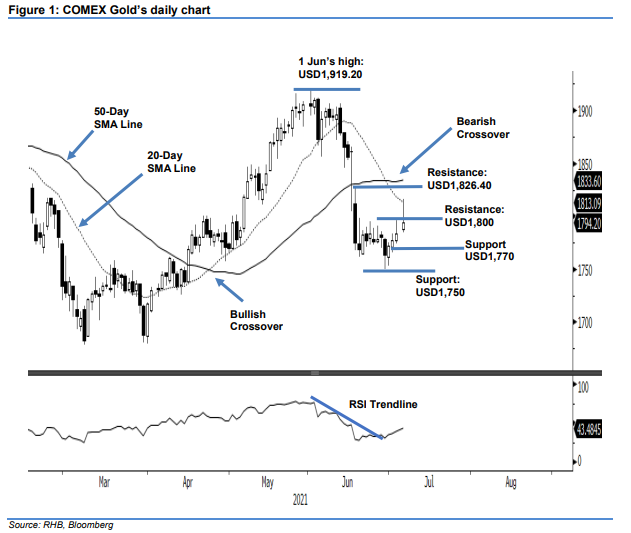

Trailing-stop triggered; Initiate long positions. Riding on recent bullish momentum, the COMEX Gold breached above the USD1,790 resistance level yesterday, despite paring early gains to settle at USD1,794.20. After starting the session at USD1,787.50, and forming its intraday low at USD1,784.70, the commodity jumped to the intraday high of USD1,815.70. Profit-taking activity brought it lower to close at USD1,794.20. With the RSI indicator curving up, bullish momentum is growing gradually. The momentum will accelerate if the indicator crosses above the 50% threshold in the coming sessions. We expect USD1,770 to provide support for the upward movement. As the trailing-stop was breached, we shift to bullish bias.

We closed out the short positions initiated at USD1,873.30, or the closing level of 3 Jun, after the trailing-stop was triggered at USD1,790. Conversely, we initiate long positions at 6 Jul’s closing level, or USD1,794.20. To manage risks, the initial stop-loss is set at USD1,750.

The immediate support is marked at USD1,770, followed by the USD1,750 round figure. The nearest resistance is projected at the USD1,800 psychological level, and the higher hurdle at USD1,826.40, or 17 Jun’s high.

Source: RHB Securities Research - 7 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024