FCPO - Rejected At MYR3,900

rhboskres

Publish date: Wed, 07 Jul 2021, 05:50 PM

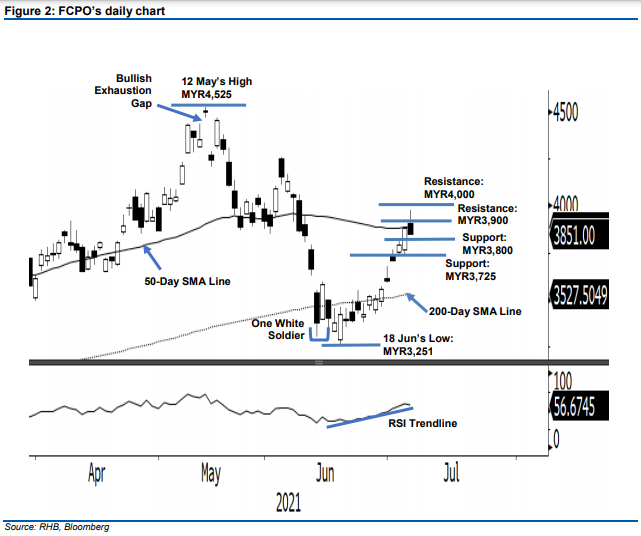

Maintain long positions. Despite the strong price action during its early session, the FCPO was rejected from the MYR3,900 resistance level, falling MYR29 to settle at MYR3,851. Yesterday, after opening at MYR3,908, it moved higher towards MYR3,978 – the intraday high – just before the noon break. When the session resumed in the afternoon, the commodity saw profit taking and changed its direction, falling to the MYR3,840 intraday low before closing at MYR3,851 and forming a “Dark Cloud Cover” bearish reversal pattern. This formation signals the likelihood of the bulls’ exhaustion from the recent rally – as such, the index may retrace lower in the coming sessions. It needs to form a “lower low” pattern to confirm the bearish reversal signal. Sentiment may turn bearish if the commodity falls below the MYR3,800 support level. On the other hand, the bullish momentum may emerge again if the commodity is able to cross above the MYR3,900 level. Since the “lower low” pattern has yet to be sighted, we stick to our positive trading bias.

We suggest traders remain long positions. We initiated these at 25 Jun’s close of MYR3,520. To manage risks, the trailing-stop threshold is revised to MYR3,800.

The immediate support levels are maintained at MYR3,800, followed by MYR3,725 – the low of 2 Jul. Towards the upside, the resistance levels are eyed at MYR3,900 and MYR4,000, both above the 50-day SMA line.

Source: RHB Securities Research - 7 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024