FKLI - Bearish Momentum Decelerates

rhboskres

Publish date: Wed, 07 Jul 2021, 05:54 PM

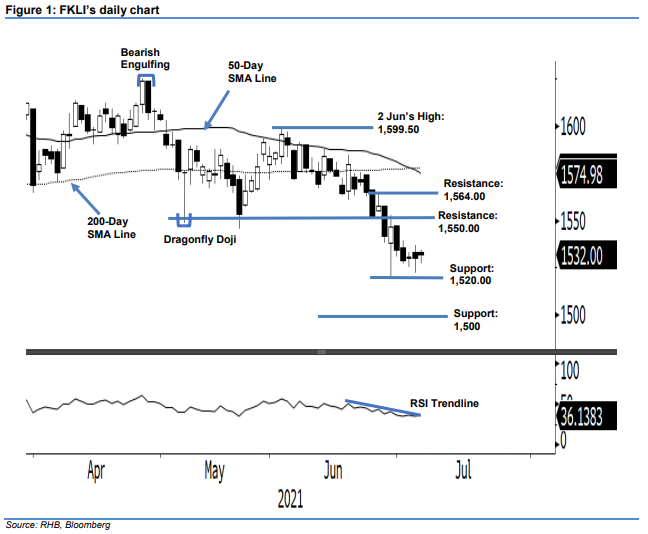

Maintain short positions. After bouncing off its support last Monday, the FKLI settled slightly higher yesterday at 1,532 pts – gaining 2 pts. The index opened at 1,533 pts then whipsawed between the low and high of 1,527 pts and 1,534.5 pts to close at 1,532 pts. The latest movement (another long lower shadow formation) suggests that the negative momentum failed to follow through while strong support is forming at 1,520 pts. As the RSI is gradually climbing higher (from 34% to 36%), this signals buying interest is gaining traction too. Despite the recent positive price action, we view the medium term trend as staying bearish until the index manages to form a “higher high” pattern – or breaches above the resistance at 1,550 pts. As such, we remain bearish in our trading bias.

Traders should stick to short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To mitigate risks, the trailing-stop is pegged at 1,550.00 pts.

The support levels are maintained at 1,520 pts, or 29 Jun’s low, and 1,500 pts – the psychological level. Towards the upside, the resistance levels are remained at 1,550.00 pts – the low of 26 Feb, and 1,564.00 pts or 25 Jun’s high.

Source: RHB Securities Research - 7 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024