FKLI - Testing The 1,520-Pt Support Level

rhboskres

Publish date: Thu, 08 Jul 2021, 09:39 AM

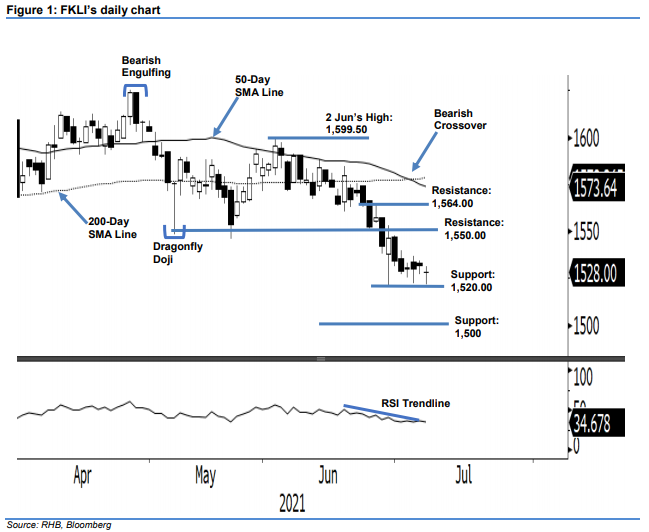

Maintain short positions. Tracking regional peer weakness, the FKLI retraced 4 pts to settle at 1,528 pts. On Wednesday, the index opened weaker at 1,528 pts. After touching the intraday high at 1,531 pts, it dropped to the day’s low of 1,521.50 pts. Towards the late session, it managed to pare the intraday losses to close at 1,528 pts. Although the session ended with a long lower shadow – indicating mild buying pressure near the day’s low – it is still premature to see a change of direction. Unless we see a long white candlestick, or a “higher higher” pattern formed, the index is still capped by the downward trajectory. Typically, the support level tends to be weak in a bearish market. As long as the trailing-stop stays intact, we make no changes to our bearish trading bias.

We recommend traders to maintain short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To control trading risks, the trailing-stop is fixed at 1,550.00 pts.

The support levels remain at 1,520 pts, or 29 Jun’s low, and 1,500 pts – the psychological level. Conversely, the resistance levels are pegged at 1,550.00 pts – the low of 26 Feb, and 1,564.00 pts, or 25 Jun’s high.

Source: RHB Securities Research - 8 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024