COMEX Gold - Crossing Above the USD1,800 Psychological Level

rhboskres

Publish date: Thu, 08 Jul 2021, 09:40 AM

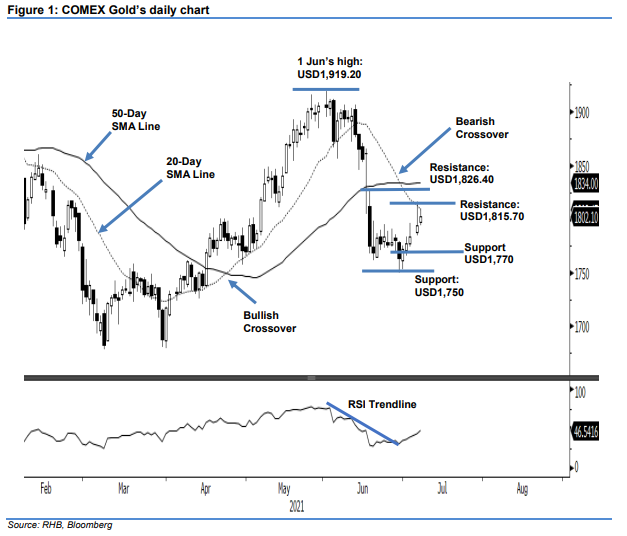

Maintain long positions. The COMEX Gold saw the bullish momentum extend yesterday, rising USD7.90 to settle at USD1,802.10. The commodity initially started Wednesday’s session at USD1,797. It found the intraday low at USD1,794.10 and turned higher to test the USD1,810.20 intraday high. Mild profit-taking saw it retrace and close at USD1,802.10. As the RSI indicator has been observed pointing upwards, this shows the recent positive price action is in tandem with the bullish momentum. The upward movement will be further strengthened if the RSI crosses the 50% threshold. Meanwhile, we expect selling pressure to exist near the 20-day SMA line with USD1,770 providing downside support. Since the bullish momentum is growing, we stick to our positive trading bias.

We recommend traders maintain long positions, which we initiated at USD1,794.20, ie the closing level of 6 Jul. To manage risks, we adjust the stop-loss threshold to USD1,760.

The immediate support is placed at USD1,770, followed by the USD1,750 round figure. The nearest resistance is pegged at USD1,815.70 – the high of 6 Jul – with the higher one at USD1,826.40, ie 17 Jun’s high.

Source: RHB Securities Research - 8 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024