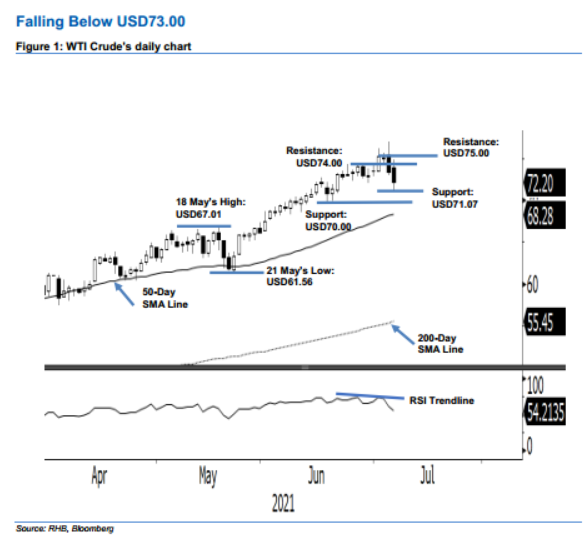

WTI Crude - Falling Below USD73.00

rhboskres

Publish date: Thu, 08 Jul 2021, 10:01 AM

Trailing stop triggered, initiate short positions. Sentiment became jittery yesterday and the bulls decided to trim positions, which saw the WTI Crude decline USD1.17 to settle at USD72.20. The commodity opened at USD73.85 yesterday and rose to test the intraday high of USD74.86 with a brief bullish momentum. Sentiment shifted during the US session, where the WTI Crude fell to the USD71.07 day low before closing at USD72.20. It printed a bearish candlestick after breaking below USD73.00. With two consecutive bearish sessions, this signals that a correction phase has started – it may retrace towards the 50-day SMA line. Before that, the commodity will test the USD71.07 and USD70.00 support levels. Since it fell below the trailing-stop threshold, we shift to a negative trading bias.

We closed out the long positions initiated at USD66.05, or the closing level of 24 May, after the USD73.00 trailingstop was breached. Conversely, we initiate short positions at the closing level of 7 Jul, ie USD72.20. For risk management, an initial stop loss is set at USD75.35.

The immediate support is marked at USD71.07 – the low of 7 Jul – and followed by the USD70.00 psychological level. On the upside, the immediate resistance is pegged at USD74.00 and then the USD75.00 whole number.

Source: RHB Securities Research - 8 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024