FKLI - Bears Testing The 1,500-Pt Leve

rhboskres

Publish date: Fri, 09 Jul 2021, 05:25 PM

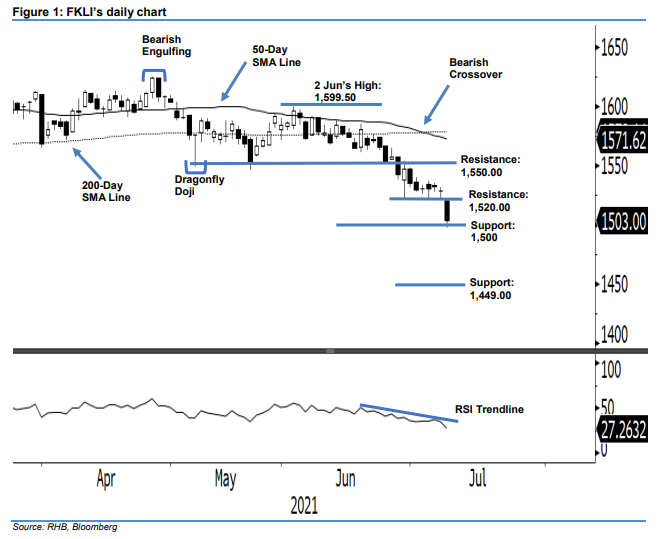

Maintain short positions. In line with the direction of regional peers, the FKLI plunged 25 pts to settle at 1,503 pts. Yesterday, the index started with a gap down at 1,520 pts and drifted lower on negative momentum to touch 1,496.5 pts – the day’s low – before rebounding mildly to close at 1,503 pts. The latest session ended with a long black candlestick while forming a “lower low” bearish pattern – signifiying sentiment is more negative now. The immediate support, which stands at 1,500 pts, will likely be tested in the coming sessions. The bearish momentum may only be reversed if the index forms a “higher high”, or at least, reclaim its 1,520-pt level. From our technical standpoint, we stick to our bearish trading bias.

We suggest traders to stay in short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To control trading risks, the trailing-stop is pegged at 1,550.00 pts.

The support levels are changed to 1,500 pts – the psychological level, followed by the lowest level in Nov 2020 at 1,449 pts. Conversely, the immediate resistance level is set at 1,520.00 pts – the low of 29 Jun, and then 1,550.00 pts, or 26 Feb’s low.

Source: RHB Securities Research - 9 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024