Hang Seng Index Futures - Falling to the 7-Month Low

rhboskres

Publish date: Fri, 09 Jul 2021, 05:25 PM

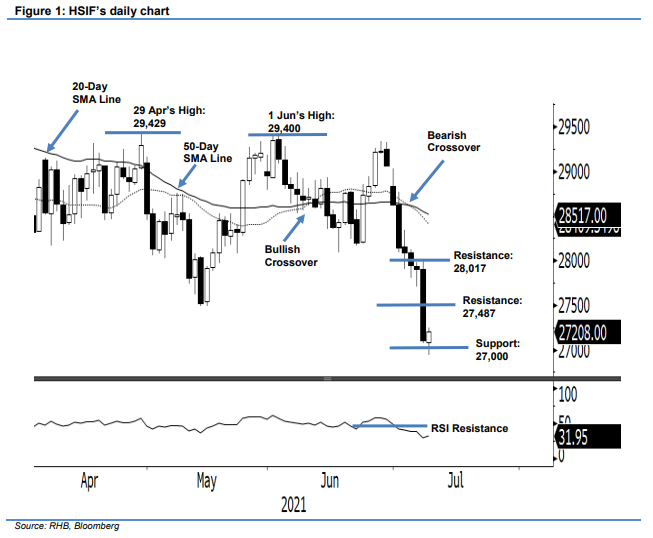

Maintain short positions. Amidst a risk-off environment, the HSIF saw its worst session since 26 Feb, plunging 802 pts to settle at 27,100 pts – wiping off the gains made in 2021. On Thursday, the index started the day session at 27,867 pts. After briefly touching the 27,887-pt day high, selling pressure brought it lower to the 27,072-pt day low – it closed at 27,100 pts. It only managed to recouped 108 pts during the evening session, last trading at 27,208 pts where it formed a long lower shadow near the 27,000-pt psychological level. In the span of just two sessions, the HSIF has fallen from 28,000 pts to the next big figure at 27,000 pts – a 1000-pt difference that indicates it may reach an interim low. We expect a mild technical rebound near 27,000 pts. On a larger time scale, since the index is moving on a downtrend, any immediate term rebound will be met by selling pressure. We retain our negative trading bias.

We recommend traders keep the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. To mitigate risks, the trailing-stop level is placed at the 28,000-pt round figure.

The immediate support is marked at 27,000 pts – the psychological level – and followed by the 26,600-pt whole number. The immediate resistance is seen at 27,487 pts – 13 May’s low – and followed by 28,017 pts, ie 8 Jul’s high

Source: RHB Securities Research - 9 Jul 2021

.png)