WTI Crude - Bulls Not Giving Up Yet

rhboskres

Publish date: Fri, 09 Jul 2021, 05:26 PM

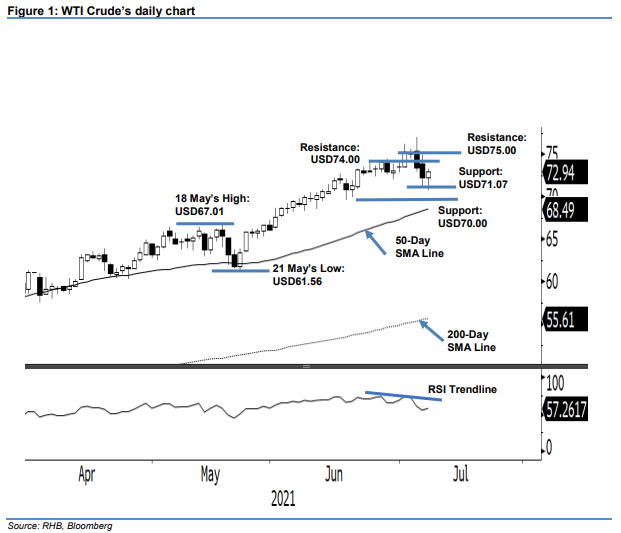

Maintain short positions. The WTI Crude managed to stage a mild rebound yesterday, rising a marginal USD0.74 to settle at USD72.94. After two consecutive bearish sessions, the commodity started Thursday’s session at USD72.17 before falling to the USD70.76 session low. It then recovered the intraday losses and rose to USD73.26 session high before closing at USD72.94. Despite a positive price action yesterday, we still see a “lower low” and “lower high” printed on the chart – this indicates that the corrective phase remains in force. Unles the WTI Crude is able to cross above the resistance level to form a fresh “higher high”,we stick to our negative trading bias.

We recommend traders shift to short positions initiated at USD72.20, or the closing level of 7 Jul. To control the trading risks, an initial stop loss is placed at USD75.35.

The immediate support stays at USD71.07 – the low of 7 Jul – and followed by the USD70.00 psychological level. Conversely, the immediate resistance remains at USD74.00 and then the USD75.00 whole number.

Source: RHB Securities Research - 9 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024